|

by Dr. Tim Coles

New Dawn Special Issue Vol 13 No 3

June

2019

from

NewDawnMagazine Website

|

Dr

T.J. Coles is an associate researcher at the

Organisation for Propaganda Studies, a columnist with

Axis of Logic, a contributor to numerous publications

(including CounterPunch and Truthout) and the author of

several books including Manufacturing Terrorism (Clairview

Books), Human Wrongs (iff Books) and Privatized Planet

(New Internationalist). |

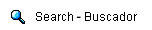

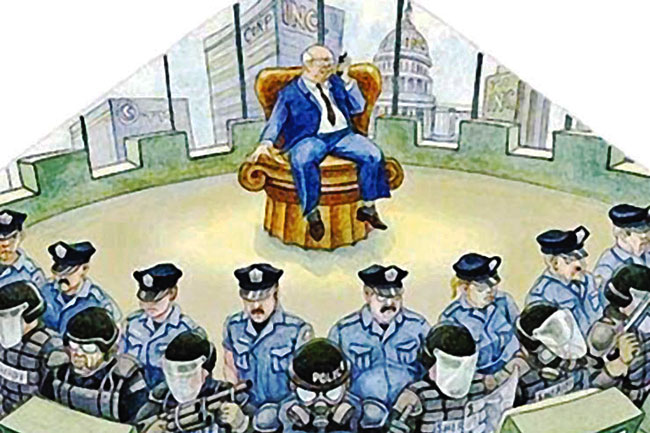

There is a new, mega-rich global elite consisting of a small number

of billionaires and multibillionaires.

Many of them made their

money in the technology sector. Others play financial markets or

inherit fortunes. They are wealthier and more powerful than some

entire nation-states.

The British Ministry of Defence (MoD) says:

"Whilst there have

always been differences between the wealthier, better educated

and the less privileged, these differences appear likely to

widen in the coming decades."

The mega-rich

deliberately order the world in ways that guarantee their wealth by

institutionalizing inequality.

Occasionally, this is

admitted.

In 1997, a book published

by the Royal Institute for International Affairs (RIIA)

in the UK acknowledged:

"The present

international order may not be the best of all possible worlds,

but for one of the 'fat cats of the West' enjoying a privileged

position in an international society that is structured and

organized in ways which perpetuate those privileges, there are

good reasons for not pursuing radical change."

This is also true of

internal policymaking.

The third richest man in

the world, Warren Buffett (worth over $80bn), confirmed this:

"There's been class

warfare for the last 20 years, and my class has won."

This echoes his statement

in 2006, just prior to

the global financial crisis:

"There's class

warfare all right... but it's my class, the rich class, that's

making war, and we're winning."

Around the same time, the

liquidity firm Citigroup circulated an investor memo, stating:

"Society and

governments need to be amenable to disproportionately

allow/encourage the few to retain that fatter profit share."

More recently, the UK MoD

admitted:

"In the coming

decades, the very highest earners will almost certainly remain

rich, entrenching the power of a small elite. Vested interests

could reduce the prospect of economic reforms that would benefit

the poorest."

Consider the enormous

concentration of wealth and power that results from this imbalance.

Ever-Increasing Power

Global and national inequality is staggering and getting worse.

By 2011, a mere 147 -

mainly U.S. and European - corporations owned and controlled 40% of

world trade and investment.

Just four corporations

influence the profitability and power of these 147:

-

McGraw-Hill,

which owns Standard & Poor's ratings agency

-

Northwestern

Mutual, owner of the indexer Russell Investments

-

the CME Group,

which owns 90% of the Dow Jones market index

-

Barclay's bond

fund index

Evaluative decisions by

analysts at these firms affect the wealth and performance of each of

the 147 giants.

That's corporate wealth concentration.

But what about wealth

concentration among individuals?

There are 7.7 billion

people in the world.

Of those, just 2,153

are billionaires.

According to Forbes,

their combined wealth totals $8.7 trillion.

The list of billionaires

reflects where power is most concentrated:

in

the U.S....

While China and Europe's

number of billionaires declined in the previous 12 months, the U.S.

and Brazil gained billionaires.

The U.S. is home to 607

billionaires or 0.000001% of the population. It is worth noting that

President

Donald Trump was a billionaire

before he came to power. Trump has cut taxes for his fellow

billionaires.

As an indication of

continued wealth concentration, consider the wealth disparity among

the billionaire class itself.

He Xiangjian, founder

of the Midea Group, is the joint-50th richest person,

worth over $19.8bn.

Jeff Bezos, by comparison, the

founder of Amazon, is the richest man in the world, worth over

$131bn - more than six times He Xiangjian.

Part of the problem has

been the U.S.-led imposition of an economic dogma called "neoliberalism"

(which is neither new nor liberal) on much of the rest

of the world.

Neoliberalism can be roughly

defined as:

-

Financialization,

i.e., allowing investors to make money from money as opposed

to tangible things;

-

Deregulating

financial services;

-

Taking out

government insurance policies so that working people bail

out financial institutions;

-

Cutting taxes for

the wealthy;

-

Privatizing

public services to reduce social mobility;

-

Imposing

austerity to make markets more attractive to investors.

Neoliberalism has

cut taxes for the super-rich, enabling them to hold onto their

wealth at the expense of others.

According to

Oxfam,

The average rate of

personal income tax for the wealthy was 62% in 1970. In 2013, it

was 38%

In the UK, the

poorest 10% pay a higher proportion of their income in taxes

than the richest 10%

Global GDP, i.e., how

much money there is in the world, is $80 trillion

But, of this, $7.6

trillion is untaxed

In the decade since

the financial crisis, the number of billionaires doubled

This reveals that the

system rewards greed

In 2017, 43 people

owned as much wealth as half the world's poorest

In 2018, the number

was 26...

To put all this into

perspective,

Jeff Bezos owns as

much wealth as the poorest fifty countries.

When it comes to more

'developed' nations, Bezos's wealth equals the entire GDP of

Hungary.

Consider how Bezos makes

his money.

Amazon is a

corporation that primarily advertises and delivers products.

The innovation,

design, and investment in and of those products is the work of

others.

Amazon treats

"workers like robots" by spying on them, discouraging unions,

offering insecure contracts, and encouraging long hours.

Amazon is also

notorious for paying little or no corporation tax.

Amazon is an online

retailer.

The Internet was

developed by the U.S. Defense Department in the 1960s as

ARPANET, with public money.

The satellites that

enable online transactions are first and foremost military

hardware.

Not only did Amazon

take advantage of state-funded innovation, but it also rewards

government investors by selling the CIA cloud technology and the

Pentagon artificial intelligence.

Bezos is far from being

the only one.

Bill Gates's Microsoft and the

late Steve Jobs's Apple, which became the first

trillion-dollar company, also enjoy low taxes, technologies

developed with government grants, and procurement contracts.

Consider also the immoral activities of other hi-tech nouvelle méga

riche.

Without making it

clear to users,

Facebook founder Mark

Zuckerberg (worth $66bn) has made his money by selling

personal data to insurers and advertisers.

Scientists have used

Facebook in social media experiments without the knowledge or

consent of users in an effort to see how memes affect mood.

Other mega-rich,

including the hedge fund manager Robert Mercer of

Renaissance Technologies, used Facebook to market political

candidates.

Other tech billionaires

include

Google founders Larry Page

and Sergey Brin.

Google technology was

funded by the CIA's venture capital firm In-Q-Tel.

Also relying on

technologies developed by the Pentagon with workers' tax

dollars, the company cooperates with the National Security

Agency (NSA)

to spy on citizens and it has even enabled U.S. assassination

programs.

Consequences

How do the billionaires get away with it, and what are the social

and political consequences?

The examples below are

from the U.S., but it should be noted that the U.S. exports its

mega-wealth model.

A study (Testing

Theories of American Politics:Elites, Interest Groups, and

AverageCitizens) by Martin Gilens and

Benjamin I. Page on

plutocracy (government by the

rich) notes that the rich buy political parties...

Politicians draft

and/or vote for laws that help the rich.

The authors analyzed

1,779 policy issues in the U.S. and conclude that,

"average citizens

and mass-based interest groups have little or no independent

influence."

Unlike the public,

"economic elites

and organized groups representing business interests have

substantial independent impacts on U.S. government policy."

Other research into

wealth inequality in the U.S. finds that,

"[c]ertain policies,

such as the decreased support for unions and tax cuts favoring

the relatively well-off and corporations, have benefitted a

small minority of the population at the expense of the majority

and have thus contributed to widening income inequality."

At the turn of the last

century, 9% of American families owned 71% of the nation's wealth.

The elite of the day

included familiar names:

...and so on.

Things balanced out after

the Second World War, with the majority of Americans becoming middle

class. Gradually, state controls over the economy were removed, and

the situation reverted to the inequality of bygone centuries.

Since the 1970s, the U.S. middle class has been shrinking.

Until recently, the

middle classes of Asia grew, precisely because strong Asian

economies (notably China, South Korea, and Singapore) either

retained some state controls or refused to adopt the U.S. neoliberal

model.

Alan B. Krueger, a labour economist and key

Obama advisor, explains that,

"since the 1970s

income has grown more for families at the top of the income

distribution than in the middle, and it has shrunk for those at

the bottom."

Between 1979 and 2007,

the top 1% ((multi)millionaires and (multi)billionaires) enjoyed a

278% increase in their after-tax incomes.

But 60% of Americans saw

their incomes rise by just 40%, which when adjusted for rising

living costs means stagnation.

Krueger notes that during

that period, $1.1 trillion of annual income was moved to the top 1%.

"Put another way, the

increase in the share of income going to the top 1% over this

period exceeds the total amount of income that the entire bottom

40 percent of households receives."

The exportation of this

model means that Australia, Britain, and Canada became what the

billionaire-dollar liquidity firm Citigroup calls "plutonomies,"

economies in which the rich drive luxury goods markets such as

jewellery, fashion, cruises, and sports cars:

hence the recent

entry of celebrity Kylie Jenner into the billionaire class.

The Citigroup document

also notes that in plutonomies the top 1% owns 40% as much

wealth as the bottom 95%.

No matter where you

live, you can't escape the institutional structures that create

inequality...

The U.S. military exists,

in part, to maintain the unjust status quo.

Yet, it acknowledges the

dangers of dominance:

"A global populace

that is increasingly attuned and sensitive to disparities in

economic resources and the diffusion of social influence,"

thanks in part to the very technologies that enrich the rich,

"will lead to further challenges to the status quo and lead to

system rattling events," like

Brexit or the

Yellow Vest protestors in

France.

The mega-rich and

international think tanks and forums they sponsor are beginning to

reluctantly accept that their status quo political puppets might get

voted out of office and give way to so-called far-left or far-right

parties unless they address wealth inequality.

The question, then, is,

how to deal with the

restless and disaffected majority while not radically altering

the system and taking away the privileges of the elite.

In 1961, U.S. President

John F Kennedy said:

"If a free society

cannot help the many who are poor, it cannot save the few who

are rich."

In the 1980s, World

Economic Forum founder Klaus Schwab said:

"Economic

globalization has entered a critical phase. A mounting backlash

against its effects... is threatening a very disruptive impact

on economic activity and social stability in many countries...

This can easily turn into revolt."

More recently, he said:

"Today, we face a

backlash against that system and the elites who are considered

to be its unilateral beneficiaries."

Likewise, the billionaire

Johann Rupert of Cartier jewellery (one of the many

luxury services driving plutonomies) said:

"We are destroying

the middle classes at this stage and it will affect us."

Similarly, the British MoD discusses "[m]anagement of societal

inequalities," as opposed to the elimination of social

inequality.

Many of the new elites

make people redundant by automating the workplace.

While Amazon still relies

on human shelf-stackers and delivery drivers, it uses an increasing

number of physical robots to stack shelves and algorithmic robots to

assist online customers.

Likewise, Facebook and

Google's content filters rely on heavy automation. This is creating

precarious employment conditions.

According to the

Washington Post (which is owned by Bezos):

"…the modern emerging

workforce of tech, urbanized professionals, and 'gig economy'

labourers all represent an entirely new political demographic."

Politicians then,

"focus more on

education, research and entrepreneurship, and less on

regulations and the priorities of labour unions."

But there are many

problems.

For one thing, the

financial services economy, which markets everything, has made

"education" a form of unsustainable debt.

The quality of U.S.

education is notoriously low by world standards, and many young

people are "overqualified" for menial jobs, like delivering for

Uber or stacking shelves in Amazon warehouses.

The UK MoD acknowledges

that,

"Freelance work is...

often low-paid, lacking the benefits and security of formal

employment and, therefore, the growth of the gig economy could

increase inequality."

The crisis of what to do

with a young, indebted, restless population automated out of steady

work by - and competing with - algorithms and physical robots has

been considered for at least 50 years.

Traditionally, 'education' meant brainwashing children to work in

menial jobs for life in adulthood.

But as the economy

changes and employment becomes less stable, new methods of

'education' for re-skilling adults are required.

In the late 1960s, future

political advisor

Zbigniew Brzezinski authored a

book in which he advocated for lifelong learning as a way of

re-skilling an aging population that finds its employment

opportunities diminished, as small-to-medium-sized businesses get

overtaken by tech giants.

Around the same time, the

British Labour Party (when it was a real labour party)

introduced the Open University with the aim of providing

lifelong learning.

Likewise, in the 1980s,

futurist Alvin Toffler envisaged an "electronic village" in

which flexible working hours and lifelong learning would be required

in a hi-tech economy.

To keep the poor from rioting while trapping them in a system that

works for those who design it, today's multibillionaire elites help

to privatize public services

and education by offering

scholarships and infrastructure investments.

In doing so,

they train poor

people to work for their system by developing others'

technology skills while hiding their own taxable wealth in 'charity

foundations.'

Howard G. Buffett is

the son of Warren. While enjoying largely tax-free wealth that

further impoverishes the global poor, the Buffetts, via Howard's

foundation, invest in dams and irrigation in the

poorest nations of Africa.

Bezos's

foundation awards scholarships for STEM courses

(Science, Technology, Engineering, Mathematics).

Zuckerberg's

foundation seeks,

"to find new ways

to leverage technology, community-driven solutions, and

collaboration to accelerate progress in Science, Education,

and within our Justice & Opportunity work."

Conclusion

By using free online

services, we have allowed ourselves to be the products that tech

giants sell to advertisers.

By not organizing to

raise taxes on the mega-wealthy, we have underfunded our public

services.

By not keeping an eye

on who's funding what, we've allowed our political parties to

hoover up donations from elites.

By failing to

understand the economy, we've allowed a new normal of

instability and political uncertainty to flourish to

the advantage of asset managers and hedge fund investors.

As the U.S. pursues

global domination, this model will continue to be exported.

It's time to wake up...!!!

|