|

by James Corbett

Michael Barr (FED), Christine Lagarde (ECB), Agustín Carstens (BIS), Klaus Schwab (WEF) and Kristalina Georgieva (IMF)

In case you haven't noticed, the wheels are falling off the global economy right now.

We've all started to feel the pinch of supply chain disruptions and rising energy costs and economic uncertainty and inflation - not to mention stagflation and shrinkflation and deflation - but this past week has really hammered home the extent of the crisis we are facing.

It seems every single day brings with it the news of some fresh five-alarm financial fire.

And that's just this week!

As I'm sure you've seen, there have been many, many such stories circulating in the financial press in recent months, all touting similarly bleak numbers.

But it's important to keep in mind that these numbers are just that: numbers. The real question is what these numbers actually mean.

Today, let's answer that question by drilling down on the narrative behind the numbers and discover what that story tells us about the bars of the financial prison that are locking into place around us.

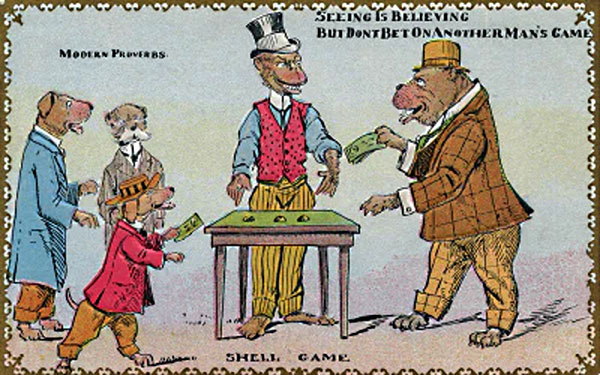

The Confidence Trick

As I have long argued, the global financial system (and the monetary order that system is predicated on) is a confidence trick in the most literal sense of that word.

This has always been so in the age of fiat currency - witness, for example, the "full faith and credit" verbiage the US Treasury and others use to describe the dollar's "backing" - but it is especially so in the last couple decades of central bank chicanery.

So, what does it mean to say that the financial system is a confidence trick?

To understand that, you have to go back to the birth of the modern monetary in Bretton Woods, New Hampshire, in 1944.

As you'll recall from my podcast episode on Bretton Woods 2.0, the Bretton Woods Agreement required signatory countries to peg their currencies to the US dollar, which itself was convertible to gold bullion at $35/ounce.

The idea was that in the post-war era, currencies would once again be backed by gold . . . by way of the dollar.

In short, the entire monetary order was to be based on the world's confidence in the US government's ability to keep its spending in check and not renege on its promise to pay its creditors in gold whenever they asked for it.

But don't worry, everyone, Uncle Sam double-dog pinky swore that he wouldn't abuse the exorbitant privilege that comes with being the issuer of the world reserve currency!

Then along came the Cold War and the Korean War and the Vietnam War and the nuclear arms race and the rise of the military-industrial complex and the birth of the cradle-to-grave Great Society nanny state and a concomitant rise in public debt and a negative balance of payments.

Some countries began to wonder if maybe - just mayyyyybe - the US government didn't actually have enough gold in its vaults to cover all of its paper promises.

But when French President Charles de Gaulle sent the French Navy across the Atlantic to politely ask Uncle Sam to convert France's dollar holdings to gold, President Nixon responded by closing the gold window and formally ending the Bretton Woods system.

From that point on, no one could pretend that the monetary order was anything but a confidence trick.

In the floating exchange rate system that developed in the wake of Bretton Woods' destruction, fiat currency is measured against fiat currency in a house of cards that only remains standing because - like the deluded subjects of the emperor in Hans Christian Andersen's fairy tale - people have been taught not to ask whether Emperor Dollar is really wearing any clothes.

It's no surprise, then, that the post-Bretton Woods era has been defined by a series of increasingly brazen attempts by the financial elite to cash in on the public's gullibility.

There was Kissinger's brokering of the petrodollar system, by which the Saudis price oil in dollars and launder those dollars back through the American financial system.

There was the Black Monday stock market crash of 1987, which led to the creation of the Plunge Protection Team, a group of high-ranking banksters and government officials that admittedly works to rig the stock market at the behest of the oligarchs.

And there was Greenspan's housing bubble in the early 2000s, which led to the Global Financial Crisis of 2008 and which was in turn papered over with a "jobless recovery" and the normalization of central bank intervention in the markets.

And now here we are at the end of the Longest Bull Run in History!!! (What Could Go Wrong???) with the wage slaves still being asked to Worship the Stock Market and pretend that it isn't commonly understood, But the tide of the last 80 years of monetary history is turning.

People are finally waking up to the fact that the emperor is indeed naked, and many are finally questioning their confidence in the system that the central bankers have created.

The (Engineered) Crisis of ConfidenceThat the entire economic order is one giant confidence game will come as no surprise to my regular readers or anyone else who has been paying attention to such matters.

What is surprising is that the mainstream financial press aren't even attempting to hide this fact anymore.

The Bezos Post frames its coverage of the inflation crisis as a matter of the public "losing faith" in the Fed. Famed billionaire investor Bill Ackman is calling for aggressive Fed rate hikes to "restore confidence" in the markets.

Even Fed chair Jerome Powell admits that what's concerning to the banksters isn't price inflation itself, but people's belief in the system, noting that the,

Indeed, by this point no one can deny that the faith which sustained the global economic con game for so long is faltering.

When the financial order was putting food on their families' table, few were inclined to question the status quo. Now that the cost of putting food on their table is skyrocketing, many have no choice but to question that status quo.

While this loss of confidence may or may not be surprising to Jerome Powell or the other mid-level functionaries of the con game, it is certainly not surprising to the string-pullers at the Bank for International Settlements - the central bank of central banks identified as the apex of financial control by Carroll Quigley in Tragedy & Hope - who have been "warning" of the inevitable result of this central bank-driven QE madness time and time again for years.

It would be the height of naïveté, however, to believe that the people at the very top of the pyramid of economic power could foresee the collapse of this system and yet do nothing to prepare for it.

In truth, of course, the BIS and the other financial elite are not sitting on their hands wondering what to do about this crisis of confidence.

Quite the contrary. They are egging it on...

The various "failures" we're seeing in the markets right now are not mere happenstance; they are problems that are either being created or worsened by deliberate action.

Inflation isn't coming out of nowhere. It is the perfectly predictable result of central bank interventions.

The supply chain is not "breaking down" for no particular reason. It has been shut down by government decree.

Food prices aren't rising because farmers are suddenly choosing to ask for more money. They're rising because governments are carefully crafting the conditions for a food apocalypse.

No, what we are experiencing is not a spontaneous economic collapse; it is the controlled demolition of the economy.

Problem Reaction Solution

That the financial elitists who have worked so assiduously to build up a world order would then turn around and contribute to the destruction of that order is only puzzling if we think they are planning on continuing the current status quo forever.

But they are not.

So they can clear the way for the new economic world order, they must first destroy the old one.

Imagine that you signed a 99-year lease on some prime Lower Manhattan office towers. Now imagine that those towers were consistently under-occupied and were going to require $200 million of asbestos removal in order to bring them up to code.

Finally, let's also imagine that you had the foresight to make sure your insurance explicitly included the right to rebuild anything you want on that land in the unlikely event of the towers' complete destruction.

In such a scenario, you might just make the calculation that it's in your interest to destroy the towers yourself and blame the act on some Muslim bogeymen.

You know, hypothetically speaking...

Similarly, if you were in a position of power over the global monetary order and you wanted to completely rebuild that order from the ground up to give you and your cronies complete control over every transaction taking place on the face of the planet, then there may come a time when you calculate that it's in your interest to begin a controlled demolition of the economy.

Not being part of that financial elite, I obviously can't say for certain whether or not that determination has been made.

I don't know how much time we have before the current order collapses altogether or whether the controlled demolition of the economy has even started in earnest yet.

After all, back during the Lehman collapse of 2008 I could hardly have conceived that the central banksters were going to be able to kick the can down the road for several more years with quantitative easing and negative interest rates and other transparent financial charlatanry.

It's certainly possible that the con men who have been running this con game for so many decades have a few more tricks up their sleeves to keep the zombie economy limping along for some time.

But what I do know - because I covered it here in these pages just last month - is that just about every single central bank in the world is now actively pursuing the implementation of a Central Bank Digital Currency (CBDC).

I know that by the end of the decade - if not much sooner - we are going to see country after country adopting and foisting retail CBDCs on their citizens with the intent of tracking every transaction in the economy in real time.

Finally, I know that an altogether new monetary instrument is unlikely to be adopted by the public absent some compelling reason, like a hyperinflationary crisis in the old monetary instrument.

Putting all of these facts together, it stands to reason that the financial order we have known our whole lives is slated for destruction and its days are numbered.

It is in the light of this knowledge that I believe we should be interpreting the current economic crisis.

It's important to understand how nicely the pieces of the broader political/geopolitical/social/financial puzzle fit together and how all of the events of the last two years bring those pieces together.

The biosecurity rollout necessitates the vaccine passports. The vaccine passports introduce the digital ID. The digital ID provides the infrastructure for the CBDCs.

The CBDCs provide a mechanism for enforcement of a social credit system (and/or a carbon credit system).

To see these events as separate events unfolding haphazardly and coincidentally is to miss the entire point. The demolition of the economy is just an excuse for the implementation of the next stage of the agenda, just as COVID-19 was an excuse for this stage of the agenda.

In short, the all-out economic assault being waged on the free peoples of the world right now is just another battlefield in the all-encompassing fifth-generation war we find ourselves fighting against the global elitists.

And, just as I noted in my recent Guide to Fifth-Generation Warfare, our ability to defend ourselves from this assault (let alone win the battle) is dependent upon knowing that we are in a war at all.

We must be able to lay the cards out on the table for our friends and family as clearly as possible:

In effect, we're standing at Ground Zero of the global economy watching the squibs going off in the Twin Towers of the global financial system.

We can either stand here, mesmerized by the pyrotechnics of the explosions, or we can fall back, regroup and take the necessary steps,

...that will be our only lifeline as the bars of the new economic prison are closing in around us.

Whatever the case, make your choice quickly.

There is little time left for deliberation...

|