|

from

RealCurrencies Website

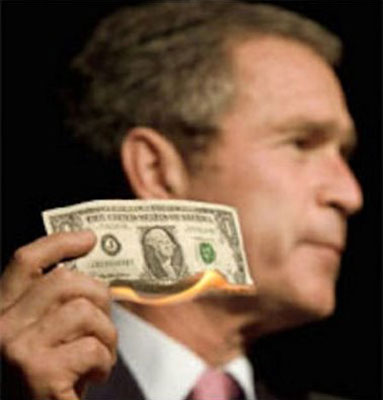

Recent developments show mounting pressure on the dollar’s reserve currency status. With a major international deflation going on, the threat of inflation through money printing is unreal.

However, should the dollar’s reserve currency

status end, the repatriation of trillions of petro- and eurodollars could

lead to a strongly inflationary scenario.

This was formalized in the 1944 Bretton Woods system.

All other currencies were fiat currencies, but

pegged to the dollar, which in turn was pegged to Gold at 40 dollars an

ounce and redeemable for international trading partners.

In the early years after the war especially for Europe, the famous Eurodollars.

This sounds great: print money and buy whatever

you like. But with the Gold window it was also risky: overprinting could

mean excess dollars would be exchanged back to Gold, depleting US Gold

reserves.

Especially the resurging Deutschmark’s appreciation became untenable.

The Europeans started pressuring the US to fix its deficits, provoking the US Treasury Secretary John Connally famous cry,

But the situation had become unsustainable and Nixon was forced to close the Gold window to stop the depletion of US gold.

This was the end of the Bretton Woods system

and from then on the major currencies were floated freely in the

international currency markets.

The Sauds agreed to invest their dollar wealth on Wall Street, making the deal even more powerful for the Empire.

Saudi Arabia controlled OPEC and the dollar was

saved: international oil trading is financed with dollar only. Since then we

have been on an informal Black Gold standard, known as the petrodollar.

There is so much oil in the world that should it

be drilled for freely, it would end the Money Power’s energy monopoly. The

Iraq invasion and the quest for control of the Middle-East is to keep a lid

on oil production. Saddam’s suicidal decision to accept Euro for his oil

only hastened his demise.

By raising the price for oil, the oil market has

mopped up excess dollar supplies, which are now needed for the oil trade. As

a result, the dollar has remained relatively stable in its value. Of course,

it fits well with the agenda of decapitating the middle classes and under

this agreement higher oil prices also means ever more oil profits invested

in Wall Street.

For all other nations this is impossible and

trade deficits are lethal in the long run, as it leads to net capital

outflow.

The dollar will have to step back and we are

seeing a realignment.

Recently Australia, which is already completely

dependent on China, with 30% of its exports going there, is preparing direct

convertibility between the Yuan and the Australian dollar, meaning they will

no longer use US dollar to finance bilateral trade. This means less US

dollars are needed in its reserve currency role.

South Africa was later added, representing Africa and emphasizing its globalist agenda. Russia and China, as two powerful neighbors, obviously have long standing and important bilateral relations.

But equally obviously, have little in common with Brazil, India and South Africa. India and China are actually sworn enemies. However, in 2009 they organized a first summit. Just a week ago we all of the sudden hear the BRICS are planning to open up a competitor to the IMF.

They’re still working out the details and it’s not a done deal yet, but the move looks very serious. And there is of course the Euro, which, make no mistake, is in great shape.

True, Eurocrat legitimacy is suffering because of the Euro crisis, even in Germany the currency is losing support.

But the Euro crisis is purely for internal consumption, to sucker the nations into surrendering budget responsibility to Brussels. This is the final frontier for a full blown EU federalist Super State.

While the Euro is deeply hated, this is not really a problem for the Money Power: it isn’t in this business to make friends and it does not mind a big fight. It only fears real alternatives and these are nowhere to be seen. There is nobody proposing anything real, people are just letting off steam.

Once they get their fiscal union, the crisis

will quickly end. People have a short memory.

There will be a number of more or less equal blocks:

These will later be able to converge to even

more ‘cooperation’, in the Money Power’s relentless march towards World

Currency.

Furthermore, the US is probably in the worst of

positions to deal with a new Gold standard. They claim to have 8,000

tonnes of Gold in Fort Knox, but nobody really believes that.

But when the dollar loses its current status,

long term price rises will become the norm.

As discussed in ‘why is Gold not Rising?‘, the ascent of Gold was a carefully orchestrated operation, but it probably got out of hand in 2011. Since then the FED has been very active on COMEX again. With CB’s and market players buying massive amounts, it’s the only logical explanation for stalling bullion.

The fall of

COMEX and the fall of the Dollar are

basically an evil twin, they will happen simultaneously and because of each

other.

|