by Charles Hugh Smith

April 2014

from CharlesHughSmith Website

We're being 'Fed' to the sharks,

every day,

one morsel at a time.

What a way to go....

The FED (Federal Reserve) Takes Our Money

...Gives it to Banks Who Loan it Back to Us at 16%

April 07, 2014

What can we say about the Federal Reserve's policies

that hasn't been said a million times?

How about simplifying

the two primary purposes of FED policies?

I will cover one

today and the second one tomorrow. Both involve feeding the 99.5% to

the financier/ Wall Street/bank sharks.

Longtime readers are familiar with Harun I.'s incisive

analysis.

Two of his recent

commentaries can be found in Resolution

#1 - Let's Call Things What They Really Are in 2014 (January

15, 2014) and Doomed

If We Do, Doomed If We Don't (February 12, 2014)

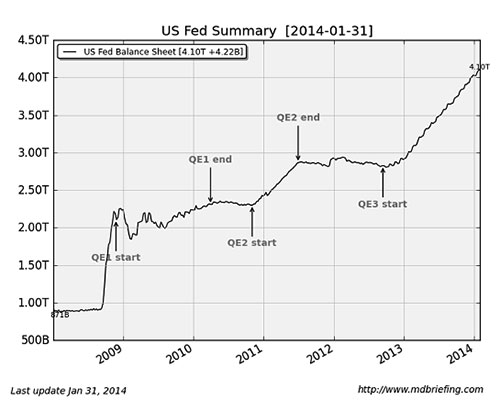

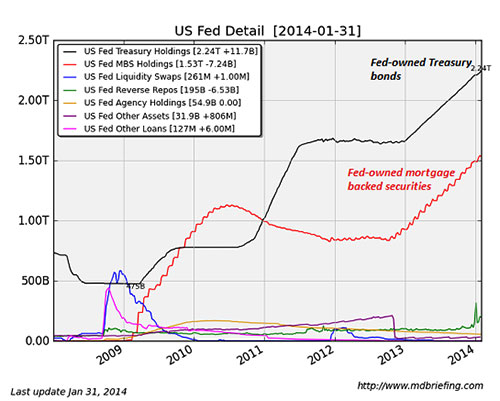

In the above entries, Harun explained how the FED's money creation

has leveraged a global bubble in assets. At 72-to-1 leverage, the

FED's $3.3 trillion money expansion has generated inflation as well

as asset bubbles, though the FED and its cronies deny both asset

bubbles and inflation.

Inflation is the FED's

explicit, stated goal. The FED wants prices to go up because that

raises GDP (gross domestic product) and makes debt cheaper to

service every year.

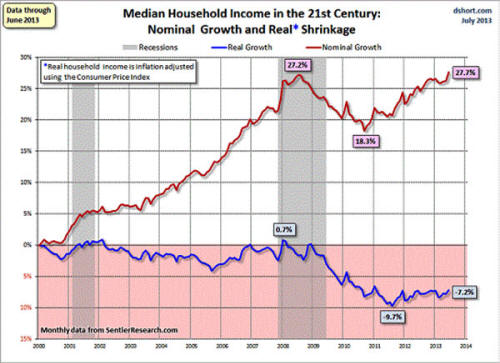

But alas, real income isn't keeping pace - it's declining. Median

household income is down 7% since 2000, but if we strip out the top

1% households, the decline for the bottom 99% would be more than 7%.

And if we strip out

the top 10% households, the decline of the bottom 90% of households

is much more than 7%.

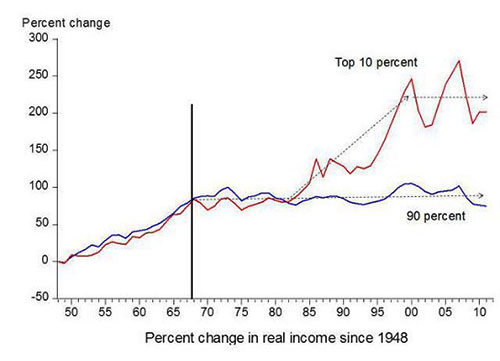

Household income for the bottom 90% has been stagnant for four

decades:

So the FED is robbing the purchasing power of our money as a matter

of policy.

In simple terms, the

FED is stealing purchasing power and delivering the stolen wealth to

the financiers and banks, who borrow money from the FED for

near-zero rates of interest.

And what do the banks do with the money the FED stole from us? They

loan it back to us at 16% (or more). Those of us who haven't just

emerged from bankruptcy get offers from banks on a weekly basis: for

transfers of credit card debt, new credit cards, cash advances, auto

loans, home equity lines of credit, you name it.

A recent offer from a Too Big to Fail bank offered a teaser

rate of 0% for a few months, after which the credit card's interest

rate reverted to 16%.

This is how the FED rebuilds the TBTF banks' insolvent balance

sheets: it strips purchasing power from wage earners and savers and

gives the banks free money which they loan to debt-serfs for

somewhere between 5% and 24%, depending on the length of the loan

and the collateral (or lack thereof).

As Harun explained, the FED steals our wealth, transfers it to the

banks who then loan our money back to us at 16%.

It almost makes you wish the FED would just steal the money openly

and give it to the banks and top .01% of financiers directly,

without the sleight of hand of inflation and zero interest rate

policy (ZIRP).

The FED implicitly claims (and many foolishly believe the

propaganda) to be the ultimate financial power in the Universe:

If the FED is so powerful,

Why is it so cowardly and fearful that it has to cloak its theft of our money and its transfer of the wealth to the banks?

What's it so afraid of?

That we might wake up to the fact that we're being FED to the sharks, every day, one morsel at a time?

Housing and the Death of the Middle Class

April 08, 2014

The FED sacrificed the foundation of

middle class wealth - stable housing values - to boost bank

profits.

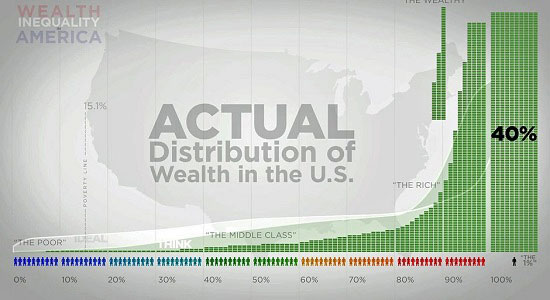

Lest you think the phrase "death of the middle class" is hyperbole, please examine these two charts, keeping in mind the middle class by definition must be in the middle of income/wealth distribution - conventionally, between 40% and 80%, i.e. the 40% between the bottom 40% and the top 20%.

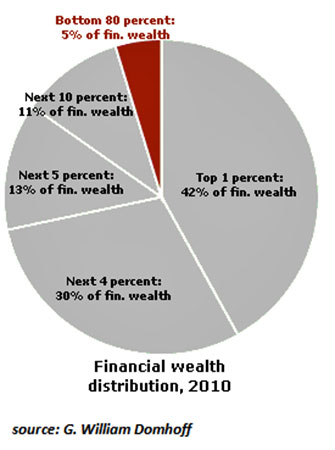

See that little red wedge?

That's the bottom 80% - the entire middle class and everyone below the middle class.

Here's another look at the wealth distribution: the middle class's share of wealth is modest, unless you define the top slice of households just below the top 1% as "middle class."

But since the top 19% cannot be in the "middle," attempting to boost the wealth of the middle class by including the wealthy is truly Orwellian.

Why has the middle class eroded? We can start by looking at income. As noted yesterday in FED to the Sharks, Part 1, household income for the bottom 90% has stagnated for 40 years.

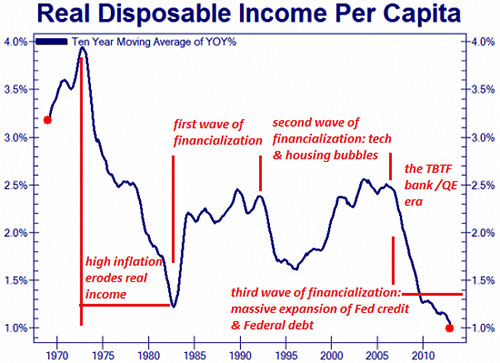

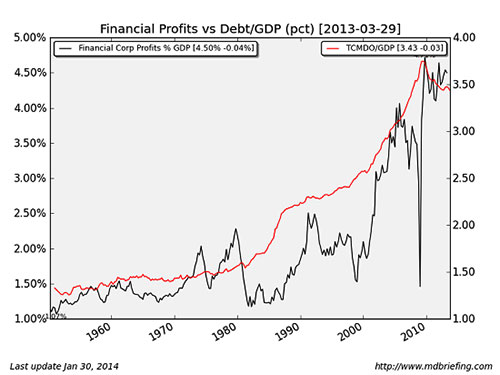

The next chart shows how financialization boosted asset valuations in waves of boom and bust.

Some of the first two waves of financialization leaked into wages, but the FED's bubble-blowing since 2009 has failed miserably to increase incomes:

disposable income fell off a cliff in 2009 and has continued falling, despite the FED's blowing new bubbles in bonds, stocks and housing.

So what does the FED have to do with the death of the middle class?

As noted in What's the Primary Cause of Wealth Inequality? Financialization (March 24, 2014), the short answer is when investment returns exceed economic growth, the rich get richer, increasing inequality.

And when do investment returns exceed economic growth? When the Federal Reserve makes credit very cheap for financiers and speculators, which drives up asset prices as everyone with access to cheap credit bids up assets.

Low interest rates and free-flowing credit inflate bubbles. We can discern an implicit agenda in the FED's policy of making credit cheap and abundant: since income for the bottom 90% is stagnating, the only way to boost consumption and debt is to inflate an asset owned by middle class households: housing.

Unfortunately, credit-driven speculative bubbles inevitably burst and housing valuations crashed.

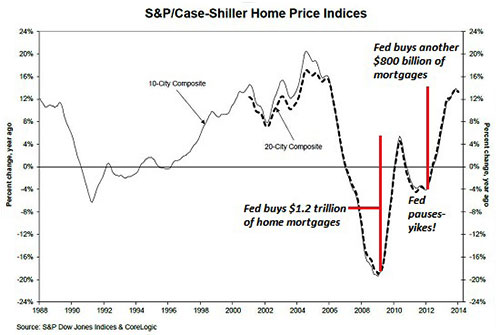

The FED responded to the housing crash with an unprecedented policy of buying over $1 trillion in home mortgages (mortgage-backed securities), roughly 10% of all existing mortgages in the U.S.

In conjunction with the FED's other policies (purchasing Treasury bonds and relaxing banking rules) and the opening of the loose-lending FHA spigots, housing recovered nicely - until the FED slackened the pace of its purchases of bonds and mortgages.

Housing immediately began trending down. In response, the FED restarted buying Treasuries and mortgages in enormous quantities.

And sure enough, housing recovered.

But asset bubbles do not replace income or savings.

The only way to benefit from bubbles in housing is to trade:

buy in at the bottom and sell out at the top.

In essence, the FED's bubble-blowing forced every homeowner into becoming a speculator.

There's another agenda at work of course: increasing debt and bank profits derived from debt. What better way to insure banking profits than to spark a speculative bubble in the core asset of the middle class - housing.

Rising prices created temporary (and enticing) home equity that could be tapped with a loan (HELOCs - home equity line of credit), and the temptation to selling out and moving up the food chain to a bigger home and bigger mortgage was equally compelling.

Even better, banks and

Wall Street had perfected the securitization of

once-safe home mortgages. Banks had no need to take on

the risk of holding mortgages - the big money was in

originating the mortgages, packaging them into

securities and selling the tranches to investors.

The much-ballyhooed "ownership society" turned out to be ownership of debt, not equity. Debt is profitable for banks; people owning homes free and clear is not.

In effect, the FED sacrificed the foundation of middle class wealth - stable housing values - to boost bank profits. Take a look at what happened to financial profits in the 2002-2007 housing bubble: they skyrocketed to new heights.

And look what happened when housing and the banks' securitization scams blew up: financial profits completely collapsed.

Middle class wealth was FED to the sharks.

As the current housing bubble deflates, the investor-buyers who fueled the rally are exiting en masse: what's the value of an asset when the bid vanishes, i.e. there's nobody left who's willing to pay today's prices?

The FED has failed to restore middle class wealth with its latest housing bubble, and the costs of the bubble's collapse will fall not on the FED but on those who believed the recovery was more than FED manipulation.