|

by Juergen Baetz

April 21, 2011

from

AssociatedPress Website

|

Frank Jordans in

Geneva, Camille Rusticci in Paris, Yu Bing in Beijing,

Jon Fahey in Washington, Jim Heintz in Moscow and Shino

Yuasa in Tokyo

contributed to this

report. |

BERLIN (AP)

From the U.S. to Japan, it's illegal to

drive a car without sufficient insurance, yet governments have

chosen to run the world's 443 nuclear power plants with hardly any

insurance coverage whatsoever.

Japan's Fukushima

Dai-ichi nuclear disaster, which will leave taxpayers there

with a massive bill,

highlights one of the industry's

key weaknesses - that

nuclear power is a viable source for cheap energy only if plants go

uninsured.

The plant's operator,

Tepco, had no disaster insurance.

Governments that use nuclear energy are

torn between the benefit of low-cost electricity and the risk of a

nuclear catastrophe, which could total trillions of dollars and even

bankrupt a country.

The bottom line is that it's a gamble:

Governments are hoping to

dodge a one-time disaster while they accumulate small gains over the

long-term.

Yet in financial terms, nuclear incidents can be so

devastating that the cost of full insurance would be so high as to

make nuclear energy more expensive than fossil fuels.

The cost of a worst-case nuclear accident at a German plant, for

example, has been estimated to total as much as € 7.6 trillion

($11 trillion), while the mandatory reactor insurance is only

€ 2.5 billion ($3.65 billion).

"The € 2.5 billion will be just

enough to buy the stamps for the letters of condolence," said

Olav Hohmeyer, an economist at the University of Flensburg who

is also a member of the German government's environmental

advisory body.

One estimate by a German think tank

shows that coverage for every € 1 trillion ($1.5 trillion) in

estimated damages would theoretically cost annual insurance of

€ 47 billion ($68.5 billion).

A similar situation exists for nuclear plants in the U.S., Japan,

China, France and other countries.

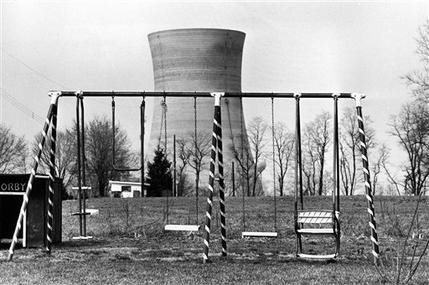

FILE - In this March

30, 1979 file photo,

a cooling tower at

the Three Mile Island nuclear power plant near Harrisburg, Pa.,

looms behind an

abandoned playground. Japan's Fukushima disaster,

which will leave

taxpayers there with a massive bill, brings to the fore one of the

industry's key weaknesses,

that nuclear

power is a viable source for cheap energy only if it goes uninsured.

(AP Photo/Barry

Thumma, file)

It is still unclear what the final cost

will be for the Fukushima Dai-ichi plant,

crippled by Japan's March

11 earthquake and tsunami.

Operator Tepco's shares have been battered, and analysts say Japan -

which already has the highest debt level among the world's

industrialized nations - might eventually have to nationalize the

company and take on its massive liabilities.

"Around the globe, nuclear risks -

be it damages to power plants or the liability risks resulting

from radiation accidents - are covered by the state. The private

insurance industry is barely liable," said Torsten Jeworrek, a

board member at Munich Re, one of the world's biggest

reinsurance companies.

In Switzerland, the obligatory insurance

for nuclear plants is being raised from 1 to 1.8 billion Swiss

francs ($2 billion), but a government agency estimates that a

Chernobyl-style disaster might cost more than 4 trillion francs -

about eight times the country's annual economic output.

A major nuclear accident is statistically extremely unlikely when

human errors, natural disasters or terror attacks are excluded, but

the world has already suffered three in just about thirty years:

Many countries back nuclear energy as a cleaner alternative to

fossil fuels, even though right now there still is no solution for

the permanent disposal of radioactive waste.

Governments could opt for a middle road, taking out more insurance

to protect taxpayers from massive bills, but that would make nuclear

energy cost more. Ultimately, the decision to keep insurance on

nuclear plants to a minimum is a way of supporting the industry.

"Capping the insurance was a clear

decision to provide a non-negligible subsidy to the technology,"

said Klaus Toepfer, a former German environment minister and

longtime head of the U.N. Environment Program (UNEP), said.

The nuclear insurance in Germany costs

utilities € 12 million ($17 million) a year or

€

0.008 cents ($0.015 cents) per kilowatt

hour of electricity, a tiny part of the final energy cost to

customers of about € 0.22 ($0.32 cents).

Increasing the liability coverage to, say, € 100 billion ($146

billion) would lead to a premium of about € 3.20 ($4.67) per

kilowatt hour, according to Bettina Meyer of the Berlin think tank

Green Budget Germany.

China, which is under international pressure to lower its use of

coal and cut its carbon emissions, is betting on nuclear power to

feed its rising energy demand. Yet it has an industry insurance pool

covering damages only up to 300 million Yuan ($46 million) and

another 800 million Yuan from the government to compensate victims,

too little to cover damages in any meaningful way.

The situation is not much better among veteran users of nuclear

energy.

In the U.S., where no new reactors have been planned and completed

since the 1979 Three Mile Island accident, the necessary insurance

for nuclear operators is capped at just $375 million per plant by

law, with further claims funded by the utilities up to a maximum of

$12.6 billion.

France, a country dotted with 58 reactors, only requires an

insurance of € 91 million ($133 million) from plant operators,

with the government guaranteeing liabilities up to € 228 million

($333 million). The figures were similar for Britain, Russia and the

Czech Republic.

Damage estimates for a worst-case nuclear disaster differ widely

because it is difficult to forecast the spillover effects of a

meltdown - death and illness from radiation, compensation for lost

work and the economic impact of massive evacuations for years.

The cost of a nuclear meltdown at the Indian Point reactors, located

24 miles (37 kilometers) north of New York City has been estimated

at up to $416 billion in a study.

But that does not take into full

account the impact on one of the world's great cities.

"A worst-case scenario could lead to

the closure of New York City for years, as happened at

Chernobyl... leading to almost unthinkable costs," University of

Pennsylvania's Howard Kunreuther and Columbia University's

Geoffrey Heal said in their 2009 study.

On Wednesday, following a brief visit to

Ukraine's crippled Chernobyl reactor, U.N. Secretary-General Ban Ki-moon

warned that the,

"unfortunate truth is that we are likely to see more

such disasters."

"To many, nuclear energy looks to be

a relatively clean and logical choice in an era of increasing

resource scarcity. Yet the record requires us to ask painful

questions: have we correctly calculated its risks and costs?"

Ban said.

In Germany, where Chernobyl's radiation

wave blew over in 1986, a 1992 study for the government, the latest

official report available, found the total cost of health damages

and other economic losses by a nuclear disaster could amount to

€ 7.6 trillion ($11.1 trillion) in today's money.

"If you take all external costs into

account, the conclusion is inevitable: Nuclear power is not

economically viable," Hohmeyer said. "The risk is only bearable

if you externalize it on the wider society."

The majority of Germans and its

political parties have concluded that the potential damage outweighs

the benefits, and the country now stands alone among industrialized

nations in its determination to abandon nuclear power.

But Dieter Marx of Germany's Nuclear Forum, an industry lobby, says

no industry has prices that reflect all of its risks, and insists

that the risk of a meltdown was very low.

"Ultimately, it comes down to the

question of how big a risk the society is ready to bear," he

said.

|