|

by James Corbett

What's more, growing up

in the shadow of his powerful, domineering and wildly successful

father, the self-conscious Pierpont (as he was called by friends and

family) seemed weak and wilting by comparison. He showed little

intellectual curiosity and was notably mercurial, often letting his

hot temper get the better of him.

Such was the case at the dawn of the 20th century, when, if you had asked the man on the street to name America's top kingmaker, its premier wheeler-dealer, its strongest string-puller, its #1 financier or its master villain, you would have invariably received just one answer:

Dubbed "the Napoleon of Wall Street" by The Economist and "the boss of the United States" by muckraking journalist Lincoln Steffens, Morgan - with his corpulent physique, his walrus moustache, his cane and top hat and a grotesquely deformed nose that was painstakingly retouched for all official photographs and portraits - supplied editorial cartoonists with the iconic emblem of the Wall Street fat cat (emphasis on fat) for decades to come.

In fact, we still recognize him as the symbol of Wall Street wealth to this very day; the artist who came up with "Rich Uncle Pennybags" (aka "The Monopoly Man") for Parker Brothers used J.P. Morgan as his model.

But it wasn't always obvious that Morgan was destined to become the world-famous caricature of wealth and greed.

John Pierpont Morgan was born in Hartford, Connecticut, in 1837 to Junius Spencer Morgan - a successful dry goods wholesaler - and Juliet Pierpont - daughter of John Pierpont, a fiery Unitarian preacher whose abolitionism and social activism eventually forced him out of the pulpit.

It has been observed by his biographers that the very different temperaments found on either side of Morgan's family tree account for the boy's own ambivalent character, equal parts cold-hearted businessman and restless firebrand.

If there is any particular moment from Morgan's biography that captures the way he combined these contradictory traits, it is perhaps his choice of "hero" for a high school graduation essay: Napoleon Bonaparte.

The boy's veneration of the famed French general certainly didn't stem from any military prowess on the part of the corpulent Morgan.

When conscripted to fight in the American Civil War in 1861, he paid a substitute (whom he called "the other Pierpont Morgan") $300 to fight in his place. (Fun fact: $300 is the same amount Morgan spent on cigars in 1863!)

No, Pierpont's choice of Napoleon as his personal hero was instead indicative of his outsized ambition and dreams of grandeur - dreams that, save for the title of "Emperor" and a crown on his head, he would eventually realize.

In 1854, Pierpont's father parlayed a stint as an import/export merchant in Boston into a partnership in Peabody & Co., the premier American merchant banking house in London.

By virtue of this appointment, the young John Pierpont Morgan enjoyed not only wealth and privilege (including an education at the most elite schools in Boston, Switzerland and Germany) but a ready-made career in banking.

Upon receiving his degree in art history from the University of Göttingen, Pierpont headed to New York, where he acted as the American liaison in Junius' growing banking empire.

With his father's already considerable banking clout behind him, the young Pierpont got to work leveraging the family's wealth with a series of brash, risky investments that set him apart from his more conservative progenitor.

A story from Pierpont's early youth and cunning that is oft-told in the feel-good biographies of Morgan revolves around an assignment he undertook as a junior accountant to study the New Orleans cotton industry.

As legend has it, during the course of his study he encountered the captain of a ship hauling a load of Brazilian coffee that had arrived in port without a buyer.

The captain was willing to sell the haul on the cheap to get rid of the beans before they spoiled, but Morgan didn't have the money to buy it himself. Instead, he used his firm's credit without the authorization to do so.

Upon learning of the risky move, his bosses shot off a telegram rebuking him for playing fast and loose with the company's finances.

But by the time the telegram arrived, Morgan had already personally sold all of the coffee to local merchants, making a tidy profit in the process.

Supposedly, this story is meant to teach us that Morgan was a hard-driving businessman with a nose for a good deal and nerves of steel . . . or something like that. What it certainly does show is his wanton disregard for other people's money in his pursuit of a lucrative deal.

His predilection for making a quick buck on someone else's dime would rear its head again during the Civil War, when Morgan engaged in his first (but certainly not his last) scheme to defraud the American public.

The scandal, known to history as the Hall Carbine Affair, first came to light in September 1861, when The New York Times reported on some "extraordinary statements" made by an anonymous source.

The source reported that John C. Fremont - a disgraced frontiersman and failed presidential candidate turned general in the Union Army - had paid $500,000 for a cache of weapons without authorization of the Ordinance Bureau.

The cache included 5,000 Hall's carbines - obsolete, single-shot, breech-loading rifles that, by the time of the Civil War, had been out of production for decades and had been,

What made Fremont's purchase so scandalous was that the Union Army had sold these very same rifles as scrap for $3.50 each just two months earlier - and here he was agreeing to buy them back for that same army at $22 each!

But how had the arms come into his possession?

As it turns out, an enterprising middleman named Simon Stevens had found a way to make an enormous profit on the old weapons by buying them up, "improving" them, and selling them to Fremont at that vastly inflated price.

And who, pray tell, had financed the scheme? Why, none other than John Pierpont Morgan...

In the end, Morgan and Stevens pocketed a tidy profit from their racket. Having paid $17,486 for the dud weapons, they turned around and sold them right back for $109,912.

Although it has never been definitively concluded that Morgan or Stevens or Fremont had deliberately engaged in a conspiracy to defraud the government, an 1862 Congressional inquiry into wartime racketeering was told that the Hall Carbine Affair was,

The scandal continued to dog Morgan to the end of his life, helping to cement his name as a byword for Wall Street avarice in the mind of the public.

But not even the moral approbation of his countrymen curbed Morgan's rapacious appetite for the almighty dollar.

In 1864, Pierpont co-founded his own firm. Shortly thereafter, he was partnered with Anthony J. Drexel of Philadelphia, one of the architects of the modern era of global finance

After Drexel's death, the firm was renamed,

The House of Morgan was born.

In the coming decades, Morgan amassed - through a combination of audacious deal-making, cutthroat business practices and underhanded duplicity - one of the largest fortunes in history.

In the process, he became one of the most powerful men in the country.

MORGANIZATION

One of the defining moments of John Pierpont Morgan's career came in 1879, when William Henry Vanderbilt - heir to the mind-boggling fortune of infamous railroad tycoon Commodore Cornelius Vanderbilt - decided to reduce his stake in the New York Central railroad his father had helped to build.

For assistance with this task, which involved liquidating 250,000 shares without collapsing the share price, Vanderbilt turned to the 42-year-old Pierpont.

Pierpont set about using every trick in his playbook to pull off the sale.

For starters, he prohibited the Vanderbilts from selling any of their shares publicly to avoid the public catching on to the scheme. Then, he tapped into the foreign market, using his father's J.S. Morgan and Company's contacts to sell an initial 50,000 share block.

He roped in British investors, desperate for a lucrative return after a period of economic depression, with a prospectus so skimpy as to be comical:

Still, no one was laughing when Pierpont announced that he had accomplished the impossible: he had sold the largest block of stock ever offered without bringing down the share price and had pocketed a cool $3 million commission in the process.

At the same time, he changed the course of financial history by shrewdly demanding a seat on the railroad's board of directors.

So began a new age of banking, one in which bankers were not financiers advising clients from the side, but fat cats like Morgan taking an active role in the management of the companies they were financing.

This was the era of "Morganization," in which the American economy was increasingly bought, sold, financed and brought under the direct management of John Pierpont Morgan.

Starting with the railroads and expanding to encompass vast swaths of the burgeoning American industrial economy, Morgan would take over failing businesses, rejigger their structures and operations, modernize their practices, and restore them to profitability.

As compensation, he always took a seat on the board, meaning that by the latter part of the 19th century he was a director of numerous companies across the country, which gave him further leverage for his next takeovers.

Indeed, in the closing decade of the 19th century, it would have been difficult to find an American enterprise or industry that escaped the grasp of John Pierpont Morgan.

Indeed, it's difficult to put Morgan's wealth and influence at the turn of the 20th century into terms that are relatable in today's world.

It wasn't just physical cash (or gold) that contributed to his wealth, it was the number of corporations and the size of the industries under his control.

In All the Presidents' Bankers - The Hidden Alliances That Drive American Power, author and historian (and previous Corbett Report guest) Nomi Prins details the way that Morgan "cracked the nut" of modern finance by parlaying his amorphous financial power into real-world control of business and, ultimately, of society itself.

But it wasn't money that motivated Pierpont.

By using the immense capital under his control, he could direct society itself, determining the fate of individual companies and indeed entire industries by extending credit to those ventures he favored and starving it from those he despised.

And, if it was power that Morgan was after, he was remarkably successful.

The completion of Morgan's long-planned metamorphosis from financial kingpin to political kingmaker can be pinpointed to a specific date: February 4, 1895.

That was the day when John Pierpont Morgan barged into the White House to make President Grover Cleveland a deal he couldn't refuse.

You see, in 1894, European investors - spooked by the Panic of 1893 and subsequent falling prices and rising unemployment - began taking their dollar holdings out of the US in the form of gold.

By February of 1895, the US Treasury’s gold reserves had dropped to dangerously low levels, and President Cleveland was desperate for a solution.

Having made his way to Washington at the height of the crisis, Morgan found himself face to face with Cleveland in a White House meeting on February 4th.

A clerk interrupted them to report that there was only $9 million in gold bullion left in the government vaults, whereupon Pierpont told Cleveland of a $10 million draft that was about to be presented to the Treasury.

From there, Morgan put his pre-arranged plan into action.

Working together with the Rothschilds in London, Morgan purchased 3.5 million ounces of gold in exchange for $65 million of thirty-year gold bonds.

The issue was a remarkable success; the bonds sold out in under two hours in London and in only twenty-two minutes in New York.

Pierpont and the Rothschilds booked a $6-to-$7 million profit in under an hour, simply by combining their names and reputation with the full faith and credit of the United States government.

As soon as the public became aware that they had been fleeced, the backlash was immense.

But it was too late.

Now the only thing left for Morgan to do was to convert his de facto power into de jure reality.

PANIC - REACTION - SOLUTION

Of all the gambits in Morgan's storied career, his most significant maneuver was made during what came to be known as the Panic of 1907.

It started in October of that year, when an already-jittery New York Stock Exchange was rocked by a dramatic failed short squeeze on United Copper Company.

The ensuing panic brought down institutions from brokerage houses to state savings banks and ended up on the doorstep of Knickerbocker Trust Company, the third-largest trust corporation on Wall Street.

When the Morgan-controlled National Bank of Commerce announced on October 21st that it was refusing to act as a clearinghouse for Knickerbocker (a Morgan competitor), the trust went belly up.

Within days, the entire American banking sector and stock market was facing a meltdown.

So began several frenzied weeks of scheming, organized by Morgan, to draw together the funds to keep the banks open and the stock exchange trading. As usual, his wheeling and dealing was at other people's expense.

At one point, Morgan locked 120 prestigious bank officials and trust company executives in his library to force them to pledge $25 million of their money to keep the country's weaker institutions afloat.

Then, when the captive bankers finally acquiesced, he took credit for arranging the deal.

When the dust finally settled on the panic and order returned to the market, a new consensus had emerged around two points.

Both notions were hogwash, of course.

In fact, not only had Morgan received undeserved praise for bailing out the economy with other people's money, he had also managed to escape blame for having created the panic.

And yes, there is every reason to conclude that he did deliberately cause the crisis in the first place for his own selfish gain.

In the April 1949 edition of Life magazine, Frederick Lewis Allen raised the obvious question:

Although Allen cited some of the evidence that led many to this conclusion - including the fact that Morgan had sparked the panic in the first place by refusing to backstop the Knickerbocker Trust and the fact that Morgan partner George W. Perkins had inflamed the panic by planting a false story about the Trust Company of America's insolvency in The New York Times - he dutifully pooh-poohed any notion of conspiracy.

On the surface, that argument sounds plausible.

Would Morgan really have sent a boulder rolling simply to kill off rival banks and businesses? Surely not...

The demise of Morgan rival Knickerbocker Trust and the ouster of Morgan rival George Westinghouse from his own company's board can both be chalked up to unexpected (but, from Morgan's perspective, not unwelcome) fallout from the pandemonium, right? Right.

But would Morgan have purposely caused the crash to consolidate the entire monetary system of the United States under the control of a handful of bankers - namely, Morgan himself and his top banking associates?

You bet your bottom dollar he would...

In order to fathom what the Panic of 1907 was really about, we have to understand that the crisis and resulting loss of faith in the public resulted (quite predictably) in a call for the government to step in and stabilize the banking sector.

After all, men like Morgan and the "Money Trust" (as the banksters were known in that day) should not be granted the power to save (or sink) the economy by themselves.

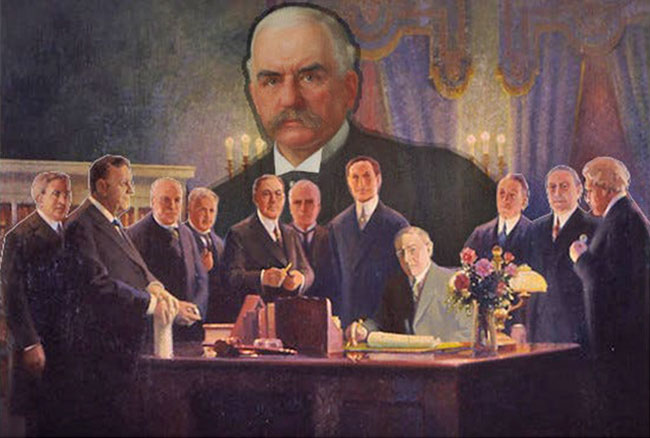

The public outcry for a solution to this problem led to the formation of the National Monetary Commission, a study group headed by Senator Nelson Aldrich, the father-in-law of John D. Rockefeller Jr. and close ally of the Morgan banking interests.

The commission's final report called for the creation of a "national reserve association," a type of central bank, to stabilize the banking sector.

As viewers of Century of Enslavement - The History of the Federal Reserve will remember, it was during the period of the commission's work that Aldrich and the Morgan/Rockefeller interests infamously slipped away to Jekyll Island in the middle of the night to draft their plan for America's next central bank.

And, as viewers of that documentary will also know, the Aldrich Plan that was ultimately presented to Congress was never adopted. Instead, it was recast as the Federal Reserve Act and passed in a highly unusual manner in 1913, two days before Christmas.

And, just like that, the bankster oligarchy - with Morgan at its head - was now part of a legal cartel able to control the nation's money supply.

The bankers' apotheosis had been achieved. Morgan's decades-long quest to turn his wealth into political power had been realized. With the central bank of the United States under the control of the money trust that he himself had created, John Pierpont Morgan could finally feel himself the equal of his powerful childhood hero, Napoleon.

Unfortunately for old Pierpont, he did not live to see his crowning achievement. He died in March 1913, nine months before the

POWER BEHIND THE THRONE

From Pierpont's perspective, it was doubtless a shame that he never saw the Federal Reserve, the culmination of his entire life's work, come to fruition.

But perhaps it could be argued that by that point, the passage of the Federal Reserve Act was a mere formality.

After all, by 1913 no one could doubt that John Pierpont Morgan was the true ruler of the nation's finances...

There's an oft-repeated story that when the value of Morgan's holdings was totaled after his death, it revealed him to have been much less wealthy than many imagined.

One version of this story holds that, upon learning the size of Morgan's estate after his death, John D. Rockefeller himself remarked,

Another version purports to reveal the real reason Morgan died a poor man: he was merely an agent of the Rothschilds.

He had never dealt with any funds other than those given to him by that infamous European banking family and had never wielded any power except that which his Jewish paymasters granted him, this version posits.

The only problem with such stories is that they're total nonsense.

While it is true that, upon learning Morgan's estimated net worth after his death, Andrew Carnegie (not Rockefeller) is reported to have said,

...even the dullest of dullards understands the irony that such a (reported) comment is intended to invoke, placed as it is in the mouth of the fourth-richest man who ever lived.

To be sure, Morgan's "mere" $68 million estate and "paltry" $50 million art collection pale in comparison to the $380 million net worth that Andrew Carnegie achieved at the peak of his business empire and next to the mind-boggling $1.4 billion fortune that John D. Rockefeller amassed in the formation of his Standard Oil monopoly (equivalent to $340 billion in today's dollars).

But to suggest that Morgan's breathtaking fortune did not qualify him as a rich man is to miss the joke entirely.

And the suggestion that Morgan's real wealth lay (as it presumably always had) in the coffers of the Rothschilds' vaults is based on absolutely no evidence of any kind whatsoever.

As demonstrated in recent Questions For Corbett on the subject, the entire story that Morgan was a Rothschild agent comes from Eustace "Trust Me, Bro" Mullins and his sweaty-palmed fan fiction account of a secret, off-the-record meeting that took place between George Peabody - John Pierpont Morgan's father's business partner, for those keeping track at home - and Nathan Mayer Rothschild.

This imagined meeting supposedly took place the better part of a century before Mullins was even born.

He doesn't bother to say...

And even if we were to take this completely sourceless, totally-made-up-until-proven-otherwise story at face value, we would then have to accept Mullins' further assertion that this secret agreement to act as a mind-controlled Rothschild agent passed on to Junius Morgan after his partner's death (source: trust me, bro) and that it then passed on again to Pierpont after Junius' death.

As we have seen, the Morgans (father and son) certainly did work with the Rothschilds in various deals over the years, perhaps most notably in the bailing out of the US Treasury in 1895.

But, as I alluded to in QFC, the fact that the largest banking house in Europe had interactions with the largest banking house in America is hardly surprising. In fact, what's surprising is how few such interactions they had.

That there is no mention in the historical record of close Morgan/Rothschild connections is easy enough to understand.

Often, they were in direct competition with each other, as in the $300 million refinancing of the Northern Pacific Railroad in 1873 - in which a consortium led by Rothschild won out over Pierpont and Junius' challenge - or as in the British government's financing of the Boer War with Exchequer bonds - which the Rothschilds unsuccessfully tried to freeze the Morgans out of.

But the animus between the parties was not mere rivalry; both Pierpont and Junius expressed a dislike of Jewish financiers in general and the Rothschilds in particular.

When the Morgans joined with August Belmont and the Rothschilds to market the last Civil War refunding loan in 1879, Pierpont wrote to his brother-in-law in London:

And when Pierpont met Lord Revelstoke of Barings in 1904, he (according to Revelstoke),

No, if the Morgans are to be suspected of being secretly beholden to an alien power, the more likely subject of that allegiance would be the British crown.

In fact, in defending the interests of their British investors even at the expense of American interests, the Morgans were often characterized as,

The Morgans did not exactly shy away from that accusation.

Not only did both Pierpont and his father's elaborate funerals involve a memorial service at Westminster Abbey, but Pierpont's son - J.P. Morgan, Jr., sent to London to handle the family's London dealings - became an honorary member of the British establishment, being received at Windsor Castle and even in the throne room of Buckingham Castle.

But to squabble over the size of Morgan's fortune at the time of his death or to speculate on his secret allegiance to some hidden power is to miss the point of the Morgan story entirely.

Morgan's wealth was not in the form of dollars. It didn't stem from hidden connections or inscrutable backroom deals.

On the contrary...

Pierpont's life purpose was not to accumulate dollars but to accumulate influence. He didn't wish to wield that influence from the shadows as a power behind the throne but to wield it openly as the Napoleon of Wall Street.

And, by that measure, there could be no doubt that Morgan had succeeded beyond the wildest dreams of avarice.

Yes, that sickly little boy had indeed grown into one of the most powerful men in the world. And he did that by putting financiers in the driver's seat of American commerce and industry and, ultimately, by giving them the reins of government.

It was from this position of dominance that the son who bore J.P. Morgan's name would soon steer the bank that bore his name through some of the most turbulent decades in the history of the global financial markets.

But that is a story for another day...

|