|

by David Bholat and Karla Martinez Gutierrez October 18, 2019 from BankUnderground Website

But do these differences

matter?

Ownership implies

control...

The owners of corporations (shareholders) are usually abstracted from their day-to-day operations. Instead, control of corporate resources is ordinarily exercised by its management.

Therefore, to say that I own shares in a corporation has a much narrower meaning than when I say I own a bike.

In the case of a

corporation, I am mainly saying that I have a financial interest in

the business, specifically, that I am a

residual claimant on the

corporation's profits after all other claimants such as employees,

creditors and the government (taxes) have been paid.

While both modern central banks and modern corporations are often characterized by a separation between ownership and control, there are key differences in their organizational objectives.

Consequently, the issue of central bank ownership is considered by most scholars of marginal importance.

Yet the issue of central bank ownership is a salient topic to revisit at present when the constitutional basis of central banks is receiving renewed attention (Goodhart and Lastra 2017; Tucker 2018).

In what follows, we offer

a survey of the variety of central bank ownership structures

historically and globally.

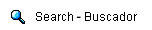

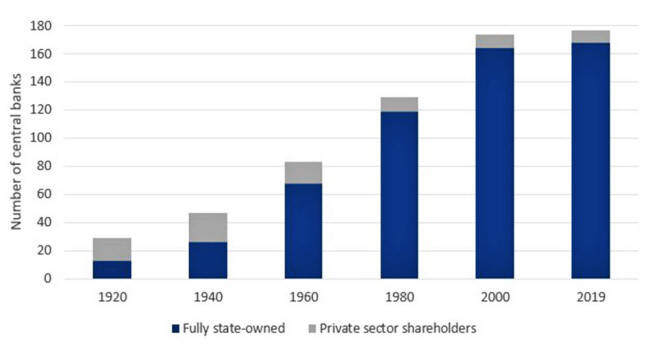

That changed mid-century...

Some established central banks, like the Bank of England, were nationalized (Figure 2). At the same time, almost all of the central banks created in post-colonial states were established fully state-owned.

By the end of the

century, just a handful of central banks with private sector

shareholders remained.

Ownership model of central banks

globally over time, 1900 to the present

List of nationalized central banks globally

in order of year nationalized

These include central banks in,

Figure 3 classifies these central banks according to whether they are owned by government, private sector banks, other private sector shareholders, or some combination of these.

The European Central Bank (ECB) represents a fourth ownership model not adequately captured by Figure 3, as it is established by treaty among EU member states.

Besides the ECB, other supra-national central banks include,

Classification of central banks by ownership

and information from central banks' websites

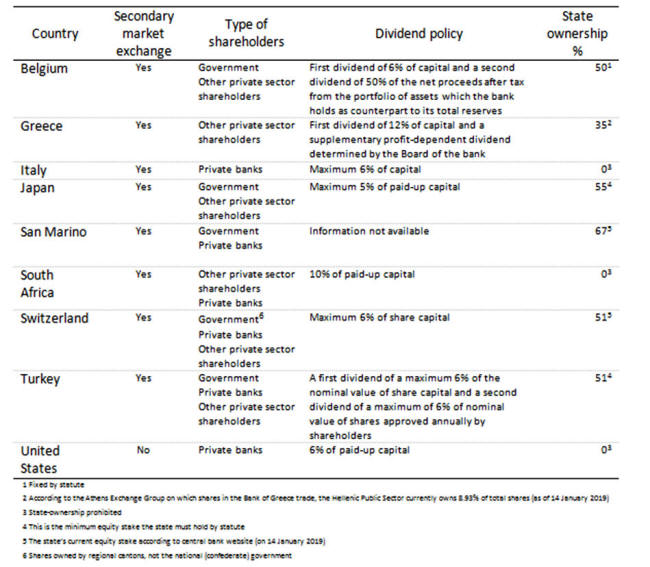

Ownership models vary considerably among these nine central banks.

Institutional detail on central banks

not fully owned by governments

In some cases, like the US Federal Reserve (FED), the amount paid to shareholders is fixed such that the dividend closely resembles a coupon payment on a bond.

In other cases, as in Turkey, the remuneration is variable and discretionary, although even here it is capped.

A recent paper (No

Smoking Gun - Private shareholders, Governance rules, and Central

Bank financial Behavior) finds that central banks with

private sector shareholders do not differ from central banks with

only public sector shareholders either in their profitability or in

the share of profits they distribute to shareholders.

Occasionally, some people argue central banks should be fully privatized, with the largest private sector banks playing the role of lenders of last resort. Conversely, some argue central banks should be fully nationalized.

However, central bank ownership on its own may not matter. Instead, the crucial factors may be other aspects of their governance, especially their mission statements.

Today, all central banks, whether wholly owned by government or with shares held by private sector entities, have mandates based on economy-wide outcomes.

A truly private sector

central bank without implicit or explicit government guarantees, and

which singularly pursued profits for its shareholders, would likely

behave differently from current central banks, which take their

objective to be the promotion of the 'public good'...

We conclude by suggesting two areas for future research.

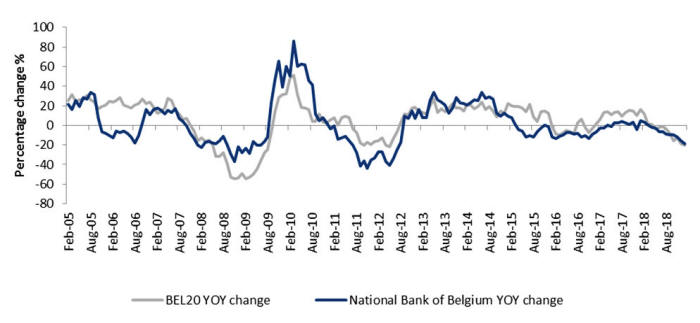

Year-on-year changes in the value of the National Bank of Belgium's stock and

the BEL

20 stock market index (r = .706)

Researchers could study whether there is any correlation between central bank ownership structure and these macroeconomic outcomes.

For example, Figure 6 plots the number of years that OECD and G20 countries have experienced financial crises between 1970 and 2017.

Countries are split between those with fully state-owned central banks, and those that have central banks with some form of private sector shareholding.

The median value (8 years in a financial crisis) is the same for both countries with fully-state owned central banks, and those that have central banks with some form of private sector shareholding over this time period.

There is thus no clear

association between financial stability and central bank ownership

structure, although we would like to see deeper empirical work to

draw firmer conclusions.

Number of years between 1970 and 2017 that OECD and G20 countries experienced a financial crisis, as defined by

the

sources below, split by central bank ownership type Harvard Business School and Laeven and Valencia (2018), supplemented by Ueda (1998), Barandiarán and Hernández (1999),

and

Lo Duca et al. (2017)

The data includes all central banks with private sector shareholders globally, with the exception of San Marino. Saudi Arabia (a G20 country) is excluded from the analysis because no information was available.

The Austrian central bank is

classified as a central bank with private sector shareholders until

2009, after which it is classified a publicly owned central bank

because it was nationalized.

|