|

by Richard W. Rahn

November 09, 2015

from WashingtonTimes Website

|

Richard W.

Rahn is a senior fellow at the Cato Institute and

chairman of the Institute for Global Economic Growth. |

Tax avoidance schemes

costs hundreds of

billions each year.

The Global

Taxers are after You

What happened to 'no taxation without

representation'?

Are you aware that the American government has been slowly giving

away its power to international bureaucrats to determine how its

businesses and citizens are taxed?

Most wars do not turn out the way the people who started them

intended.

Setting aside the hot military wars,

look at the consequences of the "war on drugs" and the "war on money

laundering and tax evasion."

The global war on money laundering and

tax evasion has failed in the three decades since it began in

earnest, and it is now on its way to undermining the rule of law

around the world, the legitimate role of financial institutions, and

the right of sovereign governments to determine their own tax

policies.

The new anti-money-laundering laws and regulations have resulted in

millions of Americans who live abroad and others living outside

their home countries being unable to get bank accounts and other

financial services in the countries where they live.

Rather than protecting people who need financial services,

government regulations are increasing their misery. Banks avoid

potential government fines by dumping customers, whose source or use

of their money is too difficult to figure out.

International money-laundering expert,

Burke Files, reported to me

from Mombasa last week that in central Africa,

"more and more money is leaving the

banking system to seek alternative remittances.

The money is now out of the system and being shipped in bulk

currency, and the remitters are being forced to pay about 9

percent - from what was 3 percent to 4 percent."

The Financial Stability Board (FSB)

based in Basel, Switzerland, released a damning report last week on

the decline in corresponding banking as a result of excess

money-laundering regulations.

The first federal laws on money laundering and international

prohibitions were passed three decades ago, with the excuses that

the law enforcement authorities needed them to fight the drug war

and other assorted criminality, even though money laundering is

almost impossible to tightly define - being a crime of intent rather

than action.

In 1998, the Organization for Economic Cooperation and

Development (OECD)

- which has been captured by the global big-government, high-tax

lobby - published a report titled "Harmful

Tax Competition," which was widely and rightly ridiculed

because it ignored the fact that competition is good, including tax

competition.

Imagine how much higher tax rates would be in New York, Illinois and

California if their rates and inefficiencies were not at all

disciplined by better-managed states that do well without state

income taxes, such as Texas and Florida. Other things being equal,

both individuals and businesses tend to move from high-tax places to

lower-tax places around the globe as a rational response to bloated

and oppressive government.

The statist bureaucrats at the OECD and their big-government masters

were undeterred in their fight for higher taxes on others (despite

their own tax-free salaries).

They claimed that they were only trying

to make sure that money from Americans and others was not being

hidden in foreign banks to evade taxes. The non-American banks then

agreed to implement withholding on payments to Americans and others

so that the governments would get their tax money.

The OECD first agreed to it, but then reneged, demanding to know the

names of the banks' clients. This showed it was not just about

money, but control over others by

the 'political' class.

Having no choice, the banks agreed...

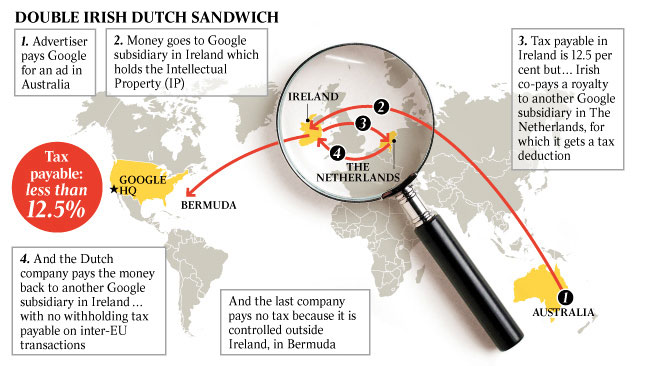

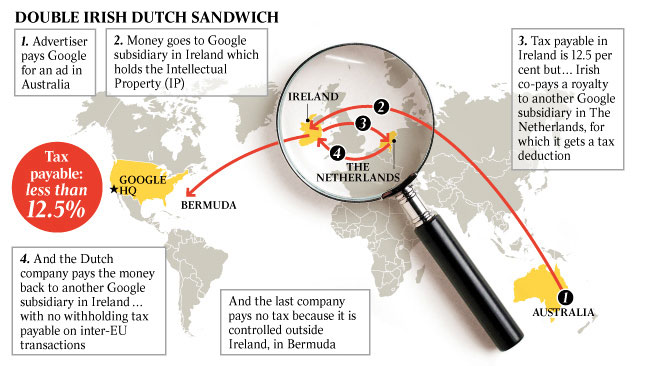

So then the OECD started going after

corporations, claiming it was "unfair" that they had some of their

activities in low-tax jurisdictions.

Now the international political class is

demanding that they determine where and how much a company should be

taxed. But this is still not enough for these greedy politicians and

bureaucrats, who are now demanding a "global minimum corporate tax,"

as Democratic Sen. Sherrod Brown of Ohio

advocated in the Nov. 6 Wall Street Journal.

Most businesses are taxed at individual - not corporate - rates,

because they are set up as sole proprietorships, partnerships and

LLCs.

You can be sure that the next effort

will be to establish a minimum tax for all businesses everywhere on

the globe, which will be quickly extended to all individuals.

What right does the United States or

France have to tell other countries what their tax rates must be?

As global taxes are increasingly

implemented, Americans and citizens of other countries will lose

their democratic right to determine their own taxes - and Americans

will be right back where they were under King George III.

What happened to "no taxation without

representation"...?

|