|

from

InternationalMan Website

A properly structured International Trust provides the maximum level of protection from anything that happens in your own country.

It provides you with the best protection possible from lawsuits, capital controls, and seizures by reckless government agencies. An international trust also helps protect family wealth from estate taxes, gives you better access to international investment opportunities, and eventually completely disconnects from the U.S. tax system.

These are just a few of the enormous benefits an international trust offers. Nothing else comes close.

Establishing an international trust isn't something you can do in the abstract, like deciding to be an existentialist or a Rosicrucian. You can't do it without choosing a specific, actual country for your trust and then a specific trust company to be your trustee.

So where to go? There's a way to figure it out. Let's start with all the possibilities.

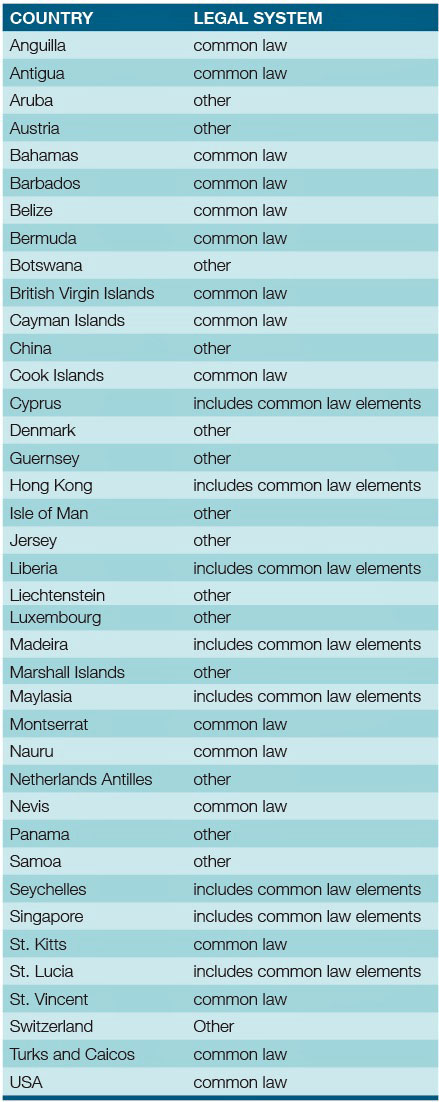

The first column in the table below lists the jurisdictions you'll find mentioned if you review publications that focus on international financial planning:

There's one country we can eliminate right away - the United States.

You might be surprised to find the U.S. on a list of international jurisdictions, but for a non-U.S. person, it is exactly that. For a non-American, the U.S. is a tax haven and a haven of stability. In the U.S., he can earn interest on bonds and CDs, and he can trade stocks and commodities, all without paying any tax.

And even though to you the U.S. political situation may feel like a nonstop riot, for people in much of the world, it seems more like group meditation.

Common Law

Next in sorting for the right jurisdiction, there's a broad category we can strike from the list - countries that didn't inherit the English legal tradition.

Trusts are a creature of that tradition and its principles of equity. Those principles both allow and compel a trustee to exercise prudent judgment and to consider all relevant facts and circumstances when it acts. Some civil law jurisdictions have enacted statutes that attempt to simulate English legal principles of equity but with results that are not entirely satisfactory.

They can leave you with a trustee that acts more like a robot than as a thoughtful and accountable decision maker.

There's a separate reason for preferring the English-law jurisdictions. Even though your hometown lawyer may not be acquainted with any of them, he's trained in the same legal tradition. He can read their statutes and understand what those laws would mean to a judge in the jurisdiction. That allows you to get advice from the sources you already know you can rely on. And - another big plus - the laws and the trust instrument you're considering using will be written in English.

Restricting the candidates to countries that follow the English legal tradition disqualifies some places, such as Switzerland and Panama, that you might imagine would be suitable.

Both countries are excellent choices for certain things:

...but neither is a good choice for a trust.

That reduces the list to:

Most of those countries are in the Atlantic or Caribbean (the A-C countries), and they have something in common in addition to English law:

That's not an absolute disqualifier for a country - you're never going to find the Land of Happy-Happy - but it is a negative, because it may represent a soft spot in the structure of long-term political stability.

Bermuda and Cayman Islands

The unhealthy social residue's importance varies from jurisdiction to jurisdiction.

Among the A-C countries, it's mildest in Bermuda and the Cayman Islands. The reason, I suspect, is that although slavery was practiced in those two countries, circumstances saved them from the worst of it. Plantation slavery, with its full-bore cruelty, was never at the center of their economies.

In the Caymans, rainfall is too scant to support plantation agriculture. Being a slave in the Cayman Islands meant servitude in someone's home, shop, or on a small fishing boat.

And Bermuda's meager endowment of land, together with its uniquely convenient location between Europe and North America, made shipping the focus of the economy from the islands' discovery in 1505 until the end of World War II.

So let's consider those two jurisdictions.

The Cayman Islands are a weak choice for an international trust, because the laws make it too easy for a creditor to break in. In particular, if a judgment creditor wins big and can force you into bankruptcy, the trust you settled in the Cayman Islands may come unglued.

Bermuda, on the other hand, has strong laws to protect your trust from future creditors.

To persuade a Bermuda court to set aside your transfer of property to a trust, your creditor must prove by a preponderance of the evidence that the transfer left you unable to pay your existing and reasonably foreseeable debts, and he must prove that your dominant purpose in making the transfer was to defeat his claim on you.

Bermuda law also protects a trust from being attacked solely on the basis that you included yourself as a beneficiary.

It's a reasonable choice, but Bermuda now comes with a serious negative. It has become exceptionally susceptible to pressure from the U.S.. Bermuda's number-one industry is reinsurance, and the industry lives in fear of being shut out of the New York market.

Relations between the U.S. and Bermuda governments have long been cordial. But in recent years, Bermuda's posture has gone from cooperative to submissive.

Bermuda courts now interpret the country's Mutual Legal Assistance Treaty with the U.S. to mean that Bermuda must comply with any request for any information if the U.S. government merely asserts that the information is needed to enforce U.S. tax laws.

There's no requirement for the U.S. to state in particular why the information is needed.

There isn't even a requirement to show that the information relates to a U.S. taxpayer. And there's no basis on which a Bermuda financial institution can resist providing the information - even if it were about the Queen's personal bank account.

For the U.S. government, Bermuda is now a goldfish bowl. That may not seem to matter because you'll have a strict obligation to file IRS reports about your trust. But look ahead. After your lifetime, your international trust will disconnect from the U.S. tax system. No one in the U.S. will have a duty to pay tax on the earnings it accumulates, and no one in the U.S. will have a duty to file reports about the trust.

So the trust you leave can be lawfully silent and lawfully invisible - if you leave it in the right place.

Others

Another A-C jurisdiction to consider is Nevis.

Its asset-protection laws go even further than Bermuda's to make things difficult for an attacker hoping to break into your trust. If you go there, I won't say you've made a terrible mistake. But there are negatives, including a heavy social hangover from plantation slavery.

Nevis is conspicuously expensive whether you're buying financial services, dinner, or a hotel room. And if the U.S. government even murmurs about cutting off airline connections, it's got something to worry about.

The rest of the A-C jurisdictions have nothing exceptional that would recommend them as locations for asset protection. Their laws allow for trusts, but they don't put up the strong barriers to potential attackers that you probably want. And some of them have particular drawbacks.

Both St. Vincent and Turks and Caicos, for example, have an embarrassing history of alleged corruption. Montserrat has a different kind of problem - an active volcano that has already destroyed the capital city. A trust can be perpetual, but Montserrat… maybe not.

Outside the A-C area, Nauru is another jurisdiction to strike from the list. Its reputation as a center for money laundering became so bad that some U.S. banks have refused to transact business with Nauru banks.

And so far as I've been able to determine, there are no trust companies in the country.

As in Musical Chairs, Ten Little Indians, and Dancing with the Stars… who's left?

Kia Orana

Just one. The best location for your international trust is the Cook Islands.

The Cook Islands are in the South Pacific and geographically are nearly a mirror image of the Hawaiian Islands - in the same time zone and the same distance from the equator.

Like the Hawaiian Islands, the main island of Rarotonga is volcanic in origin, although geologically much older.

The Cooks perform the same function for Australians and New Zealanders that Hawaii does for North Americans - a fun-in-the-sun refuge from winter weather. But it's smaller and slower. It has first-class hotels, but none with 30 stories - or even four.

No jurisdiction goes further in providing certainty that future creditors won't be able to break into a trust.

Under the Cook Islands International Trusts Act, any creditor hoping to have your transfer of property to your trust set aside for his benefit must:

This ensures that your transfers to a Cook Islands trust can't be undone by an ambush lawsuit.

The attacker must prove his case by the same standard a district attorney would face in prosecuting you for murder: beyond a reasonable doubt. If the attacker's case leaves any doubt that a reasonable person would entertain, he walks away empty-handed. (And he walks away with a lot of sunk costs, because contingency-fee litigation is prohibited in the Cook Islands.)

If he begins his case too late (there's a one-year rule), he can't walk at all.

And if you use your trust for purposes other than asset protection (such as estate planning, gaining access to non-U.S. investment markets, and protecting against the risk of the U.S. imposing capital controls), the attacker will have trouble even talking.

The Cook Islands legal system does not invite litigation.

Anyone who sues and loses may be required to pay the target's legal fees. And the attacker may be required to post a bond to cover that possibility before the litigation can proceed.

The People

The population of the Cook Islands consists of Polynesians and transplanted New Zealanders.

There's no history of slavery or colonial oppression. From 1900 to 1965, the Cook Islands were nominally a colony of New Zealand, which happily ignored and neglected the country. Today the Cooks are a self-governing parliamentary democracy patterned on the Westminster model.

As in New Zealand, the British Queen is formally the head of state, and the ultimate court of appeal is Her Majesty's Privy Council (a body of the House of Lords).

The Cook Islands rate exceptionally high for social health, which means that in practice, the laws mean what they say.

Compared to the Caribbean or even Bermuda, the difference is night and day. There are no simmering resentments. No homeless. No street people. No beggars (everyone works). No freaky hair or body piercing (certain German tourists excepted). An easy courtesy is the norm (I can't recall any exceptions) in public places.

The murder rate is one per decade. Ride a bicycle on a narrow road, and you'll find that motorists give you a wide berth. Nearly everyone you encounter offers an easygoing friendliness - including the people who have nothing to sell you.

If you live on the West Coast of the U.S., the Cook Islands is the easiest international jurisdiction in the world for you to reach - a nonstop, nine-hour flight from Los Angeles. For East-Coasters, on the other hand, it's not as easy to get to as many of the A-C jurisdictions.

Start in New York at mid-afternoon, and you won't arrive until early the next morning. But when you do arrive, take a look. If what you've come for is the unmatchable safety of a lawful international trust, you'll be in the right place.

And the beaches… Hawaiians can only dream.

Editor's Note:

For further details, you may want to check out Terry Coxon's International Trust Library, which takes all the mystery out of the topic and even introduces you to a licensed international trust company that specializes in helping people from North America.

The International Trust Library will give you everything you need to understand and create an international trust, the most powerful asset protection vehicle on the planet.

It includes all the documents you need to actually establish your trust, including the legally binding trust deed. Because the documents have already been prepared and are ready to use, you'll save thousands of dollars in legal fees.

It's a turnkey solution to a previously complex and expensive undertaking.

There's simply nothing else like it in the marketplace.

|