|

from

TheTelegraph Website Dilma Rousseff has squandered Brazil's commodity boom, but the country is not in meltdown and is unlikely to set off

an

emerging market crash.

demanding President Dilma Rousseff's impeachment

Photo: Pacific Press

/ Barcroft India

Brazil's currency has plummeted to an all-time low and borrowing costs have tightened viciously after Standard & Poor's slashed the country's debt to junk status, warning that the budget deficit has reached danger levels.

The downgrade is a painful blow to a nation that thought it had finally escaped the Latin American curse of boom-bust cycles and joined the top league of rich economies.

It is the second of the big emerging market (EM) economies to be stripped of its investment grade rating this year after Russia crashed out of the club in January.

Little remains of the BRICS allure that captivated the world seven years ago, and now looks like a marketing gimmick.

The Brazilian real tumbled to 3.90 against the US dollar as markets braced for parallel moves by Fitch or Moody's. The currency has lost 31% of its value this year and more than 60% since early 2011, when slums in the favelas of Rio were selling for the price of four-bedroom houses in the US.

Mr. Win Thin expects the real to reach 4.50 over the next three to six months in a cathartic overshoot, with the Bovespa index of equities likely to fall by another two-fifths, testing its post-Lehman low of 29,435 as the excesses of the credit bubble come home to roost.

Investors have begun to shed holdings of Brazilian debt, afraid that some funds may be forced to eject Brazil from their indexes and liquidate holdings if a second agency joins S&P.

Yields on 10-year domestic bonds spiked almost one percentage point to 15.6pc in panic trading in Sao Paolo on Thursday.

S&P said Brazil's government has failed to get a grip on rampant over-spending as tensions erupt between President Dilma Rousseff's Workers Party (PT) and her coalition partners, and the economy slides into deep recession, leaving it badly exposed as the US Federal Reserve starts to drain liquidity from the global economy.

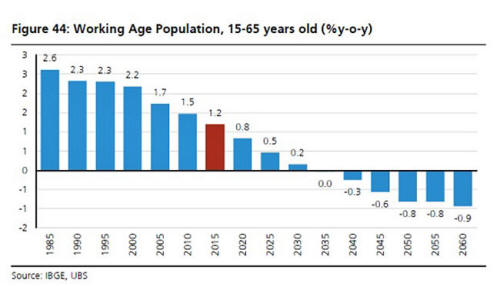

Brazil is past the demographic sweet spot and is aging

Mrs Rousseff said Brazil would,

Yet it is unclear how long she can last as momentum builds for impeachment over her role in the Petrobras corruption scandal.

Signatures were accumulating at 30,000 an hour on the pro-impeachment website on Thursday.

The country is now in a classic stagflation trap. S&P expects the economy to contract by 2.5pc this year and 0.5pc next year, causing the debt ratio to ratchet up quickly.

Mrs Rousseff is being forced to tighten policy into the recession in a belated bid to salvage credibility, just as the commodity slump eats into export revenues from iron ore and other raw materials.

The current account deficit is 4% of GDP.

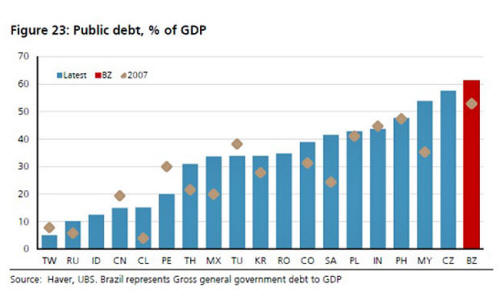

Public debt is high by EM standards, and rising fast

Gabriel Gersztein, from BNP Paribas, said nothing short of a 400 to 500 point rise in rates would stabilize the currency, but the central bank cannot plausibly do this because it would deepen the downturn, playing havoc with debt dynamics.

Bhanu Baweja, from UBS, said public debt is likely to reach 72.5% of GDP by 2018 and could rise relentlessly after that as the country passes its demographic sweet spot and starts to age rapidly.

Mr Baweja said Brazil wasted the dividend of the commodity boom and let rip with unhealthy levels of debt, mostly to finance a consumption bubble. Savings and investment have been woefully low.

The country is not facing a meltdown. Short-term external debt is trivial.

The currency has been able to take the strain, avoiding the mistake made by Asian countries in 1997-1998 when they burned through reserves trying to defend a dollar peg.

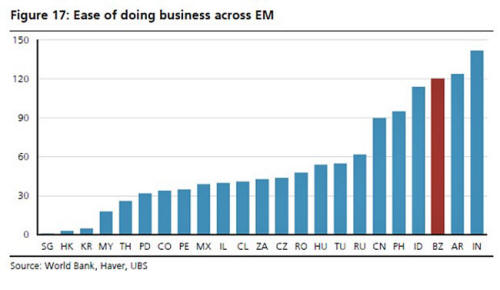

World bank index: higher the score the worse it is

Nevertheless, it has made a catalogue of errors and is now languishing in the middle income trap.

The country ranks 120 in the World Bank's Ease of Doing Business index, with catastrophic scores for infrastructure, enforcement of contracts and starting a company. The PT has back-pedaled on reforms under Mrs Rousseff, holding down prices artificially and tinkering with protectionism, though the rot set in long before she took office.

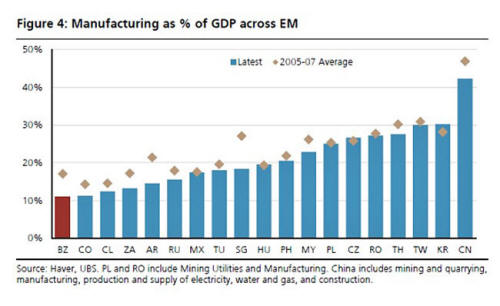

Brazil fell victim to the "Dutch Disease" during the boom, becoming dependent on commodity exports to China, while the manufacturing base shriveled to 10% of GDP.

The real became far too strong, made worse by a fatal policy mix: inflationary budget spending, which the central bank had to counter with high interest rates.

The open question is whether or not Brazil's travails imply broader EM trauma as global liquidity tightens.

David Rees, from Capital Economics, said there is plenty to worry about but EM debt is mostly long-term and in local currencies, and the commodity slump has probably hit bottom already.

|