|

March 02, 2015

from

InternationalMan Website

Emerging markets

Westerners often think of ancient Rome as the first empire. Later, other empires formed for a time. Spain became an empire, courtesy of its Armada, its conquest of the New World, and the gold and silver extracted from the West.

Great Britain owned the 19th

century but lost its empire due largely to costly wars. The U.S.

took over in the 20th century and, like Rome, rose

as a republic, with minimal central control, but is now crumbling

under its own governmental weight.

As a British subject, I remember my

younger years, when, even though the British Empire was well and

truly over, many of my fellow Brits were still behaving in a pompous

manner as though British "superiority" still existed. Not so, today

(you can only pretend for so long.)

Historically, once an empire has been shot from its perch, it's replaced by a rising power - one that's more productive and more forward thinking in every way.

Yet the U.S. is hanging on tenaciously,

and like any dying empire, its leaders are becoming increasingly

ruthless, both at home and abroad, hoping to keep up appearances.

This is being carried out both

militarily and economically, as the U.S. imposes economic sanctions

on those it seeks to conquer.

Although Europe is made up of many small

countries, often with dramatically differing cultures, who have

bickered with each other for centuries, the European Union has

cobbled them together into an ill-conceived "United

States of Europe."

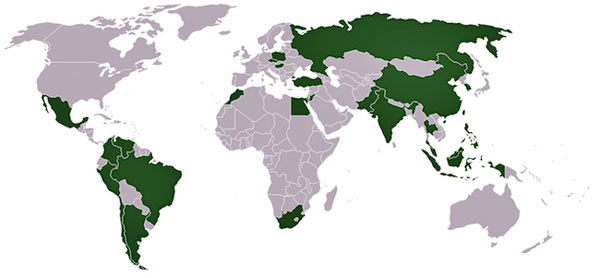

Meanwhile, the other major powers of the

world are going full steam ahead to ensure that, when the U.S. and

EU reach their Waterloo, the rest of the world will carry on

independently of the dying empire.

They are actively preparing their position to, as seamlessly as possible, take the baton at a run.

In 1944, the U.S. held more gold than

any other country, but in 1971, the U.S. went off the gold standard,

and since then, the dollar has been a fiat currency. The U.S. has

become increasingly cavalier in its abuse of the dollar - often at

the expense of other countries.

This and all trade between the two

countries will be settled in the ruble and the Yuan. Russia has

since been active in creating agreements with other fuel customers,

also bypassing the petrodollar.

So, the Sino-Russian agreement stands, not only to end the petrodollar monopoly, but to create a decline in U.S. power over the world, generally.

In recent years, the U.S. has barred, or threatened to bar, other countries from the SWIFT system, effectively making it impossible for banks to transfer money and, by extension, causing the collapse of their banking systems.

Russia has responded by creating

its own SWIFT system.

As long as Russia provides an effective money transfer service and does it without the intimidation that the U.S. employs, it's predictable that other countries would flock to the new system, in preference to SWIFT.

Once other countries are fully on board, the U.S. would have no choice but to interface with the new system or lose trade with those countries.

In 2014, China officially replaced the

U.S. as the world's largest economy, yet the IMF has consistently

sought to minimize China's place at the table.

As with the SWIFT system, the Asian

powers have reacted to U.S. overreach, not by going away licking

their wounds, but by creating a second IMF.

It will have a $100 billion pool, to be used for the BRICS countries. Its five members will contribute equally to its funding. It will be centered in Shanghai, India will serve as the first five-year rotating president, and the first chairman of the board of directors will come from Brazil.

The first chairman of the board of

governors is likely to be Russian Finance Minister Anton Siluanov.

It's therefore structured to be truly multinational.

China, Russia, and the rest of the world, when faced with American threats and bluster, will not simply fold their tents and accept that the U.S. must be obeyed. They will, instead, create alternatives. And they are doing so exceedingly well and quickly.

At this point, the overreach of the U.S.

is not only enabling other powers to rise, it is forcing their hand

to literally create the next full-blown empire.

|