|

by Andrew Gavin Marshall November-December 2014 from Occupy Website

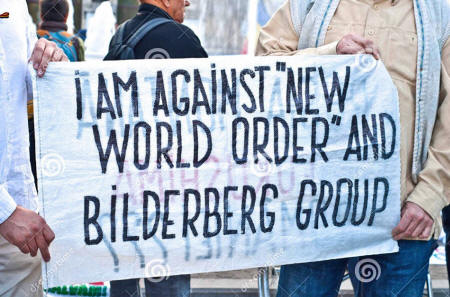

Meet the Bilderberg Group, High Priests of

Globalization

Meet the Bilderberg Group - an annual gathering of 130 of the Western world's top financial, corporate, political, academic, media, military and policy elites, held every year since 1954.

They meet behind closed doors, at five-star hotels, where participants are encouraged to speak frankly - meaning "off the record" and away from the prying eyes and piercing ears of the public. Some journalists and media executives are invited, but they don't actually cover the meetings: they simply attend them as guests.

The famous exclusivity and secrecy of the Bilderberg Group, we are told, is designed to encourage frank and open discussions among some of the most influential people in North America and Western Europe. But unlike its portrayal as a place where powerful people simply "talk shop," critics for years have considered the meetings a form of secret world government, and a shadowy cabal.

The truth, as it often is, rests somewhere between these extremes.

Bilderberg is a meeting of the movers and shakers, the managers and policy-makers, the plutocrats, technocrats, financiers and imperialists of the North Atlantic powers. Its original purpose was to provide a forum where Western European elites could meet in private with American officials to encourage the strengthening of the "Atlantic Alliance."

The forum has provided the geopolitical and economic framework for behind-the-scenes collaboration and cooperation between the major NATO powers.

Founding members of the group in 1954 included,

Named after the Hotel de Bilderberg in the Netherlands, where the first conference took place, attendees decided to hold a conference annually with locations rotating between Europe and North America.

In its early years, much of the funding for the group came from the CIA and American philanthropic foundations such as the Rockefeller Foundation and the Ford Foundation.

These institutions, along with the CIA, other major foundations and the Bilderberg conference itself, were pivotal in the early process of post-WWII European integration, laying the groundwork for what decades later would become the European Union.

In the 1955 meeting of the Bilderberg Group, the topic of "European Unity" was a major discussion point, with attendees articulating the need to eventually create a "common currency" and "a central political authority" in Europe.

One American participant reportedly encouraged the European attendees "to be practical and work fast." Within two years, the Treaty of Rome was signed, establishing the European Economic Community (EEC).

A New York Times article from 1957 noted that the first Bilderberg meeting to take place on U.S. soil represented,

Among the American participants were,

The issue of European integration remained important to attendees at Bilderberg, as a Reuters article noted in 1965, when a communiqué was issued confirming that the meeting's participants,

How It Works and Who Is Involved

Bilderberg is run by its Steering Committee of roughly 40 members whose responsibility is to organize the annual meetings and invite guests from their respective countries, bringing the average yearly attendance to roughly 130 people.

Participants and Steering Committee members come from the largest banks, corporations and think tanks; they run media empires, military and intelligence agencies.

They include European royalty and representatives from some of the world's most prominent financial and corporate dynasties, including,

...among others.

These elites meet together with top foreign and economic policy makers from North American and European nations, as well as up-and-coming politicians being groomed for high office and the heads of major international and regional organizations including,

...and some of the world's most powerful central banks.

Still, its members and leadership contend that there is nothing the public needs to worry about when all these people get together in secret meetings to discuss the major geopolitical and economic issues of the day.

Etienne Davignon, one of the chief architects of European integration in recent decades, has been a long-time Bilderberg member and was, until recently, the chairman of the steering committee.

In 2005, Davignon was quoted by the Financial Times saying that the meeting is,

In 2009, Davignon acknowledged that the formation of the euro was debated and promoted in annual Bilderberg meetings.

A decade ago, The New York Times wrote that the guest list of Bilderberg meetings,

More recently, a 2013 article from the Daily Telegraph asserted that while many members contend the group,

Referring to the group as "a club for life's winners," the article noted that former steering committee member Denis Healey said he debated the Vietnam War with Henry Kissinger, and that the group brought,

Healey was quoted saying:

Other former participants noted that it was at Bilderberg meetings where they first heard of the intentions of the West Germans to unify Germany, and where British policymakers convinced other nations in attendance to apply sanctions on Argentina during the Falklands War.

As Denis Healey explained:

Indeed, in a June 1974 Argus-Press article, the then-Chairman of Bilderberg, and one of its founding members, Prince Bernhard of the Netherlands, explained that,

Gerald Ford, who attended two Bilderberg meetings long before becoming vice president and president of the United States, was quoted in 1965 saying:

It should be noted, however, that there was one year in which the annual meeting was cancelled - 1976 - due to revelations of corruption involving bribes between the Lockheed military contractor and Prince Bernhard, leading to his resignation as chairman of the group.

In 2005, the BBC quoted then-chairman Etienne Davignon as saying:

Will Hutton, who attended a 1997 meeting, explained:

Former NATO Secretary-General and Bilderberg participant, Willy Claes, said in a 2010 interview with a Belgian radio program,

However, he added,

An anonymous former participant in Bilderberg meetings was quoted by the Financial Times in 2013 saying:

In 2001, founding member Denis Healey told the Guardian in an interview,

Speaking of the meeting's critics who contend that the member of the conference aim to achieve a type of "global government," Healey told journalist Jon Ronson:

The key issue, however, is that the world which Bilderberg is helping to shape and support is one in which financiers and industrialists are the key beneficiaries - one in which democratically-elected politicians engage with their real constituents behind closed doors, in "private" conversations that have profound and real effects upon policy and thus upon entire populations who are given no such access to public officials.

Elected leaders and policy-makers don't meet in secret with the world's major financiers and industrialists so they can discuss the best ways to serve the interests of the public, or populations, of their respective nations.

They meet to serve their own collective and individual interests.

It is not a conspiracy:

Bilderberg contributes to directly undermining democracy, while further institutionalizing technocracy - the "rule by experts" - at the national and international level.

Is the Bilderberg Group Picking Our Politicians?

When it comes to the secretive meetings of the world's financial, corporate, political and technocratic elites at the annual Bilderberg conferences, a common criticism from conspiracy theorists and others is that the group pre-selects major politicians - choosing presidents and prime ministers in private before populations have a chance to vote themselves.

Bilderberg participants contest this framing, suggesting that Bilderberg participants simply invite up-and-coming politicians who appear to have a bright future ahead of them.

The truth is that it's a bit of both.

Bilderberg invites politicians who appear to have an influential future in their respective nations, but their attendance at the meetings (depending on their ability to impress Bilderberg members and participants) can itself have a very significant influence on their political futures.

This is because the industrialists, bankers and media moguls in attendance hold significant individual and collective power over the political processes across much of the Western world.

The main ideologies that pervade the group are an undeterred commitment to corporate and financial globalization, support of a Western-led world order, and the advancement and further institutionalization of global governance. Politicians who share similar views are more likely to be invited.

As former Bilderberg chairman Etienne Davignon explained,

The result:

This is no absolute guarantee of political success for higher office, but there are numerous examples of politicians whose attendance may have provided supportive - or even pivotal - influence in their reaching higher office.

As Bilderberg's former Steering Committee member Denis Healey explained in an interview with the Guardian,

Of course, the notion of what is "sensible" is clearly biased toward policies that benefit the interests and objectives of financiers and industrialists.

The Thatcher and Clinton Factors

One good example of this is the rise of Margaret Thatcher. In 1975, when Thatcher became the leader of the opposition in British Parliament, she was invited to that year's Bilderberg conference.

A Financial Times article that year by C. Gordon Tether noted that Thatcher and other British participants,

The article noted that,

Jon Ronson interviewed the member of Bilderberg (who remained anonymous) that had invited Thatcher to the meeting.

The former Bilderberg member recalled that Thatcher had sat in silence for the first two days of the meeting, leading to some participants "grumbling" about this lady who "hasn't said a word."

So the Bilderberg member spoke with Thatcher, and then,

Four years later, Thatcher was Prime Minister, and her reign left a legacy of privatizations, neoliberalism and profit for the powerful.

But Thatcher is not the only politician who reached great heights after attending a Bilderberg meeting.

Bill Clinton was invited to a 1991 meeting in Germany when he was the Governor of Arkansas. Two years later he would be the U.S. president. Clinton was invited by his friend and Bilderberg Steering Committee member Vernon E. Jordan Jr., a major corporate figure in America who later became known as President Clinton's "closest confidant."

As the Washington Post reported in 1998:

Vernon Jordan later recalled that after Bill Clinton won the presidential election and became president,

Shaping Canada, America, the U.K. and beyond

Among the Canadian politicians who attended Bilderberg meetings before they became prime ministers were,

Former British Prime Minister Tony Blair had also attended before becoming prime minister of the UK.

Virtually all presidents of the European Commission attended Bilderberg meetings before being appointed to office.

In 2004, as John Kerry was running for president against George W. Bush, a potential running mate, John Edwards, was invited to speak at that year's Bilderberg meeting.

According to a report in the New York Times, John Edwards,

A friend of John Kerry's who had attended that meeting recalled that the speech by John Edwards,

Shortly after, Edwards was selected as Kerry's running mate (though they clearly did not win the more important election that year).

Bilderberg's Influence on Obama

In fact, it was a Bilderberg member, James A. Johnson, a prominent American corporate executive, who John Kerry tapped for choosing a running mate.

And in 2008, that same Johnson,

As the Financial Times reported in May of 2008, James Johnson was appointed,

From June 5 to 8 of 2008, Bilderberg was meeting in Chantilly, Virginia, just as the campaign to win the presidential nomination was heating up between Barack Obama and Hillary Clinton.

As is typical during campaign season, the candidates traveled with a regular entourage of journalists.

But on the night of June 5, following a campaign rally in Bristow, Virginia, Obama's press entourage was,

The press waited on the plane for Obama, who was said to be doing interviews with local reporters.

After an hour of waiting, the pilot informed the press that the plane was about to take off, without Obama on board, leading many journalists to feel that they "had all been duped."

Robert Gibbs, Obama's communications director (and later press secretary) informed the reporters on the plane that Obama decided to stay behind in Washington for "meetings," though he refused to say whom the meetings were with.

Gibbs explained:

Shortly after the plane landed in Chicago, Gibbs informed the press that Obama had gone to meet with Hillary Clinton, though provided no details of the meeting or where it took place.

At the time, there was speculation that both Obama and Clinton had gone to attend the Bilderberg meeting taking place nearby.

Though never confirmed, the question remains, and two days after the "private meetings," Hillary withdrew from the race and Obama became the presidential nominee.

Later, as president, Obama gave Clinton the role of Secretary of State.

In the summer of 2012, John Kerry attended the Bilderberg meeting, and he went on to replace Hillary Clinton as Obama's Secretary of State for the second term.

Forbes noted that Kerry's attendance at the Bilderberg meeting may have helped his selection as secretary - also noting that Canadian Mark Carney had attended his first Bilderberg meeting in 2011 when he was Governor of the Bank of Canada, and was invited back in 2012 when he attended alongside British Chancellor of the Exchequer, George Osborne.

Within a couple months of the meeting, Osborne announced Carney's appointment as the Governor of the Bank of England - the first time a non-British citizen was appointed to head the institution.

Just prior to being appointed as President of the European Council in 2009, Belgian politician Herman Van Rompuy attended a "secret dinner" of the Bilderberg group's Steering Committee in order "to promote his candidacy."

He was invited by then-Bilderberg chairman Etienne Davignon, and attending members included other leading industrialists and financiers as well as influential figures like Henry Kissinger. Van Rompuy impressed the audience.

He later served as President of the European Council from 2009 to 2014.

Attending Bilderberg is not a guarantee of higher office, but it can often support a rapid rise to state power for politicians who impress the members and guests at the annual meetings.

As Etienne Davignon explained, Bilderberg's Steering Committee,

Bilderberg Group and Its Link to World Financial

Markets

This article looks at the published lists of participants attending recent Bilderberg meetings, specifically ones that took place between 2008 and 2014.

From these lists, we're better able to understand the relevance of Bilderberg meetings to specific institutions, ideologies and powerful sectors of society connected with global economic governance. As such, the following articles in this series examine financial markets, banks, technocracy, finance ministries, central banks, the IMF and the European Union.

When discussing the Bilderberg group, its meetings and their impacts, there is one major problem: the meetings are held in secret.

When 130 of the world's most influential individuals and institutions get together behind closed doors for a "private chat," the public is left unaware of what was said, debated, agreed or decided.

The official website for Bilderberg publishes recent lists of attendees as well as a press release of the "topics" due to be discussed.

With no details added, the list for the 2014 meeting's topics included,

This is essentially all we have to go on in our efforts to discern what was debated and discussed behind the scenes.

So, instead of engaging in speculation about what was or was not discussed at Bilderberg meetings, let's instead look at the individuals and institutions that are frequently represented there.

Seeking the answers to these questions raises further inquiries:

Bilderberg and Financial Markets

Some people suggest we may judge others by the company they keep.

After all, who we choose as friends says a great deal about ourselves. Applying this logic to the Bilderberg Group, we see a body whose activities and internal discussions remain largely secret, which we can get to know better by examining the membership and guests it invites.

Bilderberg's official website provides a press release for each meeting held between 2010 and 2014.

In all of these meetings, issues such as,

...are relevant throughout.

With membership drawn primarily from North America and Western Europe, the financial and economic turmoil of the past several years has been a consistent topic of discussion and concern for Bilderberg meetings.

Within all of these issues, "financial markets" play an extremely important and influential role.

Given that Bilderberg represents the interests of some of the largest and most powerful banks and financial institutions in the world, the meeting provides a forum where "financial markets" are duly given a powerful voice.

But before we address the relevance of these financial market leaders, let's briefly define what "financial markets" are.

The Financial Times Lexicon calls them a,

In other words, "financial markets" create and collect vast sums of money (or debt) and move it around in order to collect more money and debt. Financial markets manage the investment and exchange of money and debt.

Many major institutions and actors shape financial markets. There are individual financiers, such as billionaires George Soros and Warren Buffett, who are able to move financial markets with words and actions.

There are also,

...among others.

Despite - or because of - their many different areas of operations and institutions within financial markets, the power of these groups is heavily concentrated, largely globalized and highly destructive.

Roger Altman

But don't take my word for it. Instead, take the word of a Bilderberg Steering Committee member, Roger C. Altman, who has attended every meeting since 2010.

Altman is the chairman of Evercore, which claims to be the "most active independent investment bank" in the United States.

He was a former partner at Lehman Brothers in the 1970s, became a fund-raiser for then-Governor Jimmy Carter, and later served as an Assistant Treasury Secretary in the Carter administration from 1977 to 1981, during which time he oversaw the $1.5 billion government bailout of Chrysler Corporation.

Altman returned to Wall Street in 1981, working for Lehman Brothers.

The New York Times noted that apart from his stint in the Carter administration, Altman,

He became close with the chairman of Lehman Bros., Peter G. Peterson, who founded the major investment firm Blackstone in 1987, today one of the world's largest independent asset management firms managing nearly $300 billion in assets.

Altman joined Blackstone at its founding as Vice Chairman, staying until 1993 when he was appointed as Bill Clinton's Deputy Treasury Secretary.

One of Clinton's closest economic advisers at the time, Gene Sperling, commented that Altman was,

Altman left the Clinton administration in 1995 and founded Evercore that same year, where he has remained until the present.

He is currently also a director of Conservation International, a member of the Council on Foreign Relations, the Steering Committee of Bilderberg, and regularly writes columns for the Wall Street Journal, New York Times and Financial Times.

In 2006, Altman served as an adviser to Hillary Clinton for her presidential campaign.

Today, Evercore manages over $14 billion in assets and has handled over $1.4 trillion of transactions for major global corporations, investment agencies and the super rich.

What does all this mean? It means when Roger Altman writes articles that are widely distributed and read by the key decision-makers and those who shape the global financial markets, he speaks not simply as an observer but as an active participant and player.

His words carry weight - like in December of 2011, a month after the democratically elected leaders of Greece and Italy were removed from office. The EU elite replaced those countries' leaders, who had displeased the financial markets, with economic technocrats and bankers who swiftly imposed ruthless austerity measures that punished their populations into poverty in order to pay the interest on debts to banks.

Altman wrote in the Financial Times that financial markets were,

Indeed, the markets "have become the most powerful force on earth," and when those markets flex their muscles, "the immediate impact on society can be painful" with high unemployment and collapsing governments.

But, he added,

Ultimately, Altman concluded:

Martin Wolf

Martin Wolf, another frequent Bilderberg participant, is considered to be perhaps the most influential financial journalist in the world, being the chief economics commentator and associate editor at the Financial Times.

He is consistently rated among the 100 most influential "thinkers" in the world, with,

Wolf himself once explained:

Lawrence Summers, another top economist, former Treasury official and occasional Bilderberg participant, has referred to Wolf as,

Mohamed El-Erian, former CEO of the world's largest bond trader, PIMCO, stated that Wolf was "by far, the most influential economic columnist out there," and the current governor of the central bank of India, Raghuram Rajan, commented:

Wolf himself acknowledged,

As the New Republic explained in a profile, Wolf's audience and readership,

No doubt, Wolf's consistent presence at Bilderberg meetings, and at the World Economic Forum, has helped to secure that access and maintain those connections.

Thus, when Wolf writes about issues related to financial markets, his commentary holds far more weight than when outside or more critical voices speak up.

This is all the more notable when Wolf defines and criticizes what he perceives as the primary problems of financial markets, and the financial system as a whole - which he did in 2011, writing that,

The Super-Entity

Combining the analyses of these two prominent Bilderberg members who have strong connections to leading global financiers and regulators, we can thus understand financial markets as something of a global parasite - one with unprecedented power to determine the fate of nations and peoples through investments and exchanges of money and debt.

Financial markets, in other words, represent a global parasitic social structure in which power is gained and exercised through the manipulation of numbers on screens.

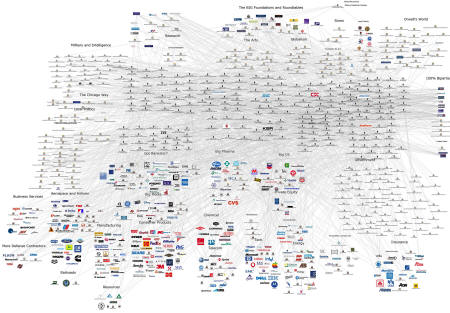

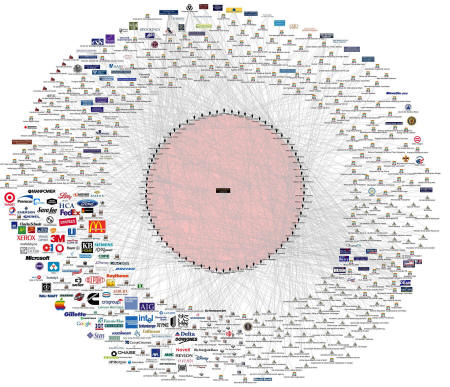

At the core of financial markets are what Swiss scientists have called the "super-entity," composed of 147 of the world's top transnational corporations, primarily banks and insurance companies concentrated in the United States, Western Europe and Japan, which collectively own each other through shareholdings.

As a group, these 147 corporations own roughly 40% of the entire network of the world's top 43,000 transnational corporations. One of the financial researchers commented,

Many of these institutions are frequently represented in Bilderberg meetings, including,

Collectively, these are the leaders in financial markets and the overlords of Roger Altman's "global supra-government."

The leaders and advisers to these banks who have been represented at Bilderberg meetings, and the influence and views they hold, will be the focus of the next installment in this series.

Part 4

In the previous Bilderberg article (above), I wrote that financial markets were,

In truth, the "super-entity" known as financial market power functions like a cartel, or an organized criminal network: a Mafia.

This installment examines some of the members of the global financial mafia who are present at Bilderberg meetings and thus are given unparalleled access to political leaders behind closed doors.

At Bilderberg meetings, participants frequently include leading officials and advisers to banks like,

...among others.

The participation of leaders and advisers to these and other large financial institutions provides world leaders with direct, "private" access to some of the leading voices at the core of global financial markets. The interests and actions of financial markets can thus be articulated to the leaders of powerful political, media, military, intelligence and technocratic institutions.

The "invisible hand" may voice where and when it might smack.

Through Bilderberg, leaders in financial markets are given an inside look at, and access to, those who shape and wield foreign and economic policy in the world's most powerful nations. Their interests become a part of that process, just as geopolitical interests are integrated into the actions of financial markets.

While financial markets command no armies, they determine the flow and functions of money upon which all armies are dependent, and to which nations are obedient.

Bilderberg brings these institutions and individuals together for an off-the-record, private chat about global affairs and policy.

This is but a small sampling of some of the names of the leaders of financial institutions represented at Bilderberg meetings over the past few years.

Apart from leading individual banks and financial institutions, many of the financiers who attend Bilderberg meetings simultaneously hold leadership positions within other large banking lobby groups, industry associations, and major international conferences.

For example, Bilderberg members and participants frequently hold simultaneous leadership positions at,

all of which have been the focus of previous installments of the Global Power Project, as they have been profoundly influential organizations in their own right.

The fact that so many leading figures in those organizations are leaders and participants in Bilderberg meetings lends extra weight to the importance of the meetings.

Roger Altman, a Bilderberg steering committee member and head of a large investment bank, wrote in a May 2013 article in the Financial Times that financial markets in the 21st century were,

The views and the desires of bankers and financiers are important - and influential - precisely because if these individuals don't get what they want, they wield the power in numbers on screens that can force the hands of even the most powerful governments and politicians.

As such, the favored policies of bankers frequently become the implemented policies of states.

Part 5

Bilderberg is an inherently technocratic institution.

It brings together top "experts" and decision-makers from a number of important sectors to engage in off-the-record conversation, speaking a "common language" in order to help design and coordinate policies that more accurately represent the interests of concentrated power.

As such, Bilderberg not only serves a technocratic function, but it is also populated with a number of the world's most influential technocrats who are members and invited guests:

Their participation in Bilderberg meetings provides them with a "private" forum in which to engage with the political, corporate and financial oligarchy.

More concretely, Bilderberg meetings enable participants to promote the expansion and further institutionalization of technocracy. But to understand Bilderberg's relevance to technocracy, let's first define the concept.

What is Technocracy?

Technocracy is largely defined as "rule by experts," or the exercise of power by "professionals."

As The Economist explained in 2011:

But the scientific management of society "was popular under capitalism too," and the magazine noted there was even a prominent "Technocratic Movement" in the United States in the early 20th century.

The late 19th and early 20th century witnessed rapid industrialization, new oligarchies, mass migration, revolution, a clash of empires between old and new, emerging technologies and inventions, expanded literacy, new energy sources and novel forms of communication and transportation.

It was an age of oligarchs and unrest. Many of the most powerful societies turned to technocracy to help manage the great transitions of the era.

As the oligarchs sought to maintain their influence by institutionalizing it within society, they also while sought to manage the expectations and interests of the population:

Capitalist, Communist (or State-Socialist) and Fascist societies turned to technocracy and the rule of experts to transform the structure of modern civilization through a "scientific management" of human society - where oligarchic power is legalized and institutionalized, and the population gives its consent, or is at least its obedience, to the ruling structure.

The Chinese Communist Party and state is largely ruled by unelected technocrats, as are several military dictatorships and one-party states.

On occasion, even Western "democratic" nations become ruled by unelected technocrats, though as The Economist noted,

Recent examples include the imposition of technocratic governments in Italy and Greece, in late 2011 when democratically elected leaders were removed of the government was handed to a former central banker.

Despite these exceptions of direct technocratic rule, there are technocratic institutions and individuals who oversee major parts of our society and determine important policies that have profound consequences for hundreds of millions, and often billions, of people around the world.

Central banks, finance ministries, international organizations, think tanks, foundations and universities are all highly influential technocratic institutions, often managed by high-level technocrats and governed (or advised) by members of the financial and corporate oligarchy.

China's Technocratic Tyranny

A November 2013 article in The Atlantic described Chinese politics as "a nightmare" for those who were "lovers of clear, concise language."

The author, Matt Schiavenza, cited the names of the top ruling body (Politburo Standing Committee), the major conference establishing policy and direction for the following years (Third Plenary Session of the 18th Party Congress), and the conference's resulting document that promised to "comprehensively deepen reforms," and argued:

The technicality and obscurity of the language serves to hide the exercise and effects of power behind an image of "expertise."

Only those who are experts in matters of law, finance, economics, political science, etc., are capable of understanding the language, and thus, the implications of its use. In China, the technocratic language of the Party and state hide the rule of not only the visible top technocrats, but of the powerful political and financial oligarchs and dynasties behind them.

China's political and economic power is concentrated in the hands of a new aristocratic class of what are called "Princelings," the descendants of Communist China's revolutionary leaders.

These leaders wielded formal political power, and after the turn to capitalism, from the late 1970s onward, the descendants of these families came to dominate the economic resources of the country.

As Bloomberg noted, in China,

For foreign businesses and banks to gain access to the Chinese market, the most effective means has been through the practice of hiring or establishing relationships with the Princelings.

Major global banks, such as,

...and others, frequently hire princelings in order gain access and influence within China's leadership, since the relatives of princelings themselves govern the bureaucracies and state-owned industries, determining the flow of money through society.

JPMorgan Chase has been under investigation by the Securities and Exchange Commission (SEC) for its practice of hiring hundreds of princelings in China to gain access to its lucrative market.

In the words of Bloomberg, these princelings have become China's "new capitalist nobility."

Wen Jiabao served as China's prime minister for the decade leading up to 2012, and his family amassed billions in assets, a practice consistent for most (if not all) of China's ruling political figures, including its new president, Xi Jinping.

Almost all of the nine members of the ruling Politburo Standing Committee under the previous Chinese government were from families that amassed enormous fortunes and controlled entire areas of the economy, with corruption "more severe than at any time in history," as the Financial Times quoted a veteran Communist Party member and journalist.

China is a one-party dictatorship with powerful military and security forces and high-tech surveillance. It is ruled by gangsters, oligarchs and technocrats.

China is, essentially, a Mafiocracy. Yet the language of its technocratic form of governance obscures this reality behind the veneer of impartiality and expertise. Behind the scenes, gangsters rule and families feud.

This reality of Chinese politics was revealed in 2012 when one of China's princelings and rising political stars, who was set to gain a seat on the Politburo Standing Committee in 2013, became the subject of a dramatic downfall worthy of the palace intrigue in ancient imperial China.

Bo Xilai's rise to power was turned into a life sentence in prison after his closest adviser sought asylum in a U.S. consulate, fearing for his life and telling the Americans that Bo Xilai's wife had murdered a British banker in a hotel room with cyanide.

The fall of Bo Xilai and his family was not a subject the Chinese leadership wanted aired publicly.

The popular attention and implications of the story were largely the result of social media being used by an increasing percentage of Chinese citizens. What was intended to be the behind-the-scenes factional power struggles of families vying for top-spots on the Politburo Standing Committee, spilled out into the public as the most dramatic news story since the Tiananmen Square massacre in 1989, and changed the course of Chinese politics.

It is also interesting to note that one of China's top technocrats, Liu He, was invited to the Bilderberg meeting in 2014. In China, Liu He is one of President Xi Jinping's top economic advisers, considered to be largely "pro-market" and seen as a prominent reformer.

The Wall Street Journal described Liu He's job as,

He has also been referred to as "China's Larry Summers."

Technocracy in the West

Much like the powerful, dramatic and shocking figures and processes hiding behind the bland language of Chinese politics, the ambiguous language of global economics and finance hides its own ruthless realities.

Behind the words and actions of central bankers, finance ministers and other top technocrats, we're able to see countries collapse, governments overthrown, populations impoverished, societies destroyed, fascism and racism explode as people riot, rebel and revolt.

The language of "financial technocracy" belies a world of mass impoverishment, exploitation, domination and immense concentrations of power.

These technocrats define and manage global financial and economic policy, construct the ideology the justifies the rule of the oligarchy, and implement policy which is intended to protect and expand the interests of that oligarchy.

As central bankers demand "fiscal tightening" and finance ministers implement "structural reforms," the populations of,

...were plunged into crisis.

Meanwhile, poverty and unemployment rise, fascist parties emerge, social unrest and riots in the streets become common, suicide rates increase, health and education systems come under strain and collapse, and governing political parties lose legitimacy and turn to police repression to control the crowds.

Economic opportunity and political democracy become things of the past. Behind the technocratic language of economics lies a world of brutality.

Bilderberg's structure, members and objectives that promote and expand the power of technocracy are inherently destructive to democracy. Europe's debt crisis, and the technocratic institutions and individuals that managed it, have had profoundly negative consequences on the lives of hundreds of millions of people.

The functions of technocracy and the actions of Europe's top technocrats effectively serve the interests of concentrated financial and corporate power.

The Bilderberg Group and the Cult of Austerity

It could almost be a slogan: Bilderberg brings people together.

Specifically, every year, the Bilderberg Group holds secret, "private" meetings at four star hotels around the world, bringing together nearly 150 of the world's most influential bankers, corporate executives, dynasties, heads-of-state, foreign policy strategists, central bankers and finance ministers.

It also invites the heads of,

Participants at Bilderberg appreciate having a closed-door forum where they can speak openly and directly to one other - and of course, not to us. But perhaps we, the people, would also like to hear what they have to say.

For the past four years, Bilderbergers have been running around the world preaching the gospel of "austerity" and "structural reform" - very important terms.

If you don't know what they mean, Bilderbergers are working their day jobs to make sure you will learn.

What is Austerity?

If you've been to Bilderberg, chances are you're a fan of austerity:

Austerity has several names and phrases, including "fiscal consolidation" and "balancing the budget." There are so many things to call it - but in the end you know it's austerity because the policies are the same and the effects of those policies are, too.

There is a reason why political and technocratic language is made to sound so vague and dull: because behind the words lie brutal actions and devastating consequences. If we understood their true meaning, their use would very often be shocking and unacceptable.

Instead, their use has become common and seemingly inconsequential.

Here, however, are the consequences:

This is how the story generally works:

At this point, one of two things happens.

If they continue funding, the country continues to make its payments, though it remains unable to fund its regular functions.

The country is left in a perpetual fiscal crisis whereby the interest payments get larger and the crisis gets deeper. This continues until financial markets stop purchasing debt.

The country is now in a major crisis. This is when rich, powerful governments and international organizations come to the "rescue" with money to lend - specifically, the United States, Germany, Britain, France, Japan, the European Union and the International Monetary Fund (IMF). But their money comes with strict conditions.

These conditions have been defined and demanded beforehand by the major banks and financial institutions, and by the plethora of economists, central banks and finance ministries that support them.

These are the "experts" and technocrats of global economic governance.

Such conditions require a country to "fix the problem" that created its fiscal crisis. But the main problem facing countries, according to bankers, economists, technocrats and politicians, is that they spend far too much money on social services that benefit their populations. Therefore, in order for a country to be able to borrow, it must implement "correct" policies designed to balance its budget and restore public finances.

These policies are collectively described as "austerity measures," and the process of implementing them is frequently referred to as "fiscal consolidation."

Long story short: governments must cut spending.

This means that healthcare, education, pensions, welfare and social services must be drastically gutted, masses of public sector employees must be fired, and taxes must be increased.

Thus, austerity creates a new class of unemployed, pushed into poverty and deprived of all the resources that are meant to help the poor and disadvantaged, let alone everyone else. The economy goes into a deep depression as people stop spending and businesses collapse, unemployment and poverty soar, suicide and mortality rates increase, and racial and ethnic conflicts erupt.

All of this is done so that a country is able to get a large loan (sometimes called a national bailout) from institutions like the IMF, European Union and the central banks of powerful U.S., Japanese and European nations. This loan is provided in order to pay the interest the country owes to the global financial cartel.

Populations are impoverished and societies are devastated in order to pay interest to global banks. All of this happens as a result of numbers on screens.

This is "austerity," or "fiscal consolidation," as we know it.

Time to Reform

Either coupled with or following from austerity measures, lenders and bankers demand that the conditions of the loans include not only "necessary" austerity measures, but also important "structural reforms."

This bland term hides policies and objectives behind it that have the effect of radically altering the entire structure of the economy over a period of several years or even decades. These "reforms" will make the economy strong and "competitive" again, and bring the country out of its austerity-induced depression.

Typical structural reforms include privatizing all state-owned companies, assets and resources, which allow foreign companies, states and banks to purchase important national assets cheaply (and provide a short cash infusion in the process).

Countries then have to further "liberalize" markets by reducing any and all government protections and regulations over specific sectors of the economy, allowing foreign banks and corporations to "compete" on an "even playing field."

This forces local and national industries, businesses and communities to compete against some of the largest transnational corporations in the world, many with more wealth and assets than their entire country is worth.

As a result, foreign investors can afford to out-compete the local economy by providing cheaper products and services while maintaining global profits. Local businesses cannot compete, so they fail or are bought up.

This often contributes to growing unemployment.

One of the key "structural reforms" demanded is "labor flexibility." In countries with unions, workers rights, pensions and protections, where the labor force has institutional power, the labor market is often considered "rigid." It does not bend to the wishes and demands of corporations and financial markets that want labor to be "flexible" to their demands.

What do they demand? Cheap, exploitable labor.

These would be hard policies to sell if those who sold them spoke plainly. Instead, they describe a world in which nations need to "increase competitiveness" and implement the necessary "structural reforms" to create "economic growth."

The point is that it's all so technical, you're not supposed to understand it.

But actually, it's pretty simple. Which is why, every day, more and more of us are getting the message.

|